-

Please adjust the volume.

3Q23 Business Results

Greetings.

I am Peter Kweon, the Head of IR at KBFG.

We will now begin the 3Q23 business results presentation. I would like to express my deepest gratitude to everyone for participating today.

We have here with us our group CFO and SEVP, Scott YH Seo, as well as other members from our group management.

We will first hear the 3Q23 major financial highlights from CFO and SEVP, Scott YH Seo, and then engage in a Q&A session. I would like to invite our CFO and SEVP to deliver 3Q23 earnings results.

Good afternoon. I am Scott YH Seo, CFO of KB Financial Group.

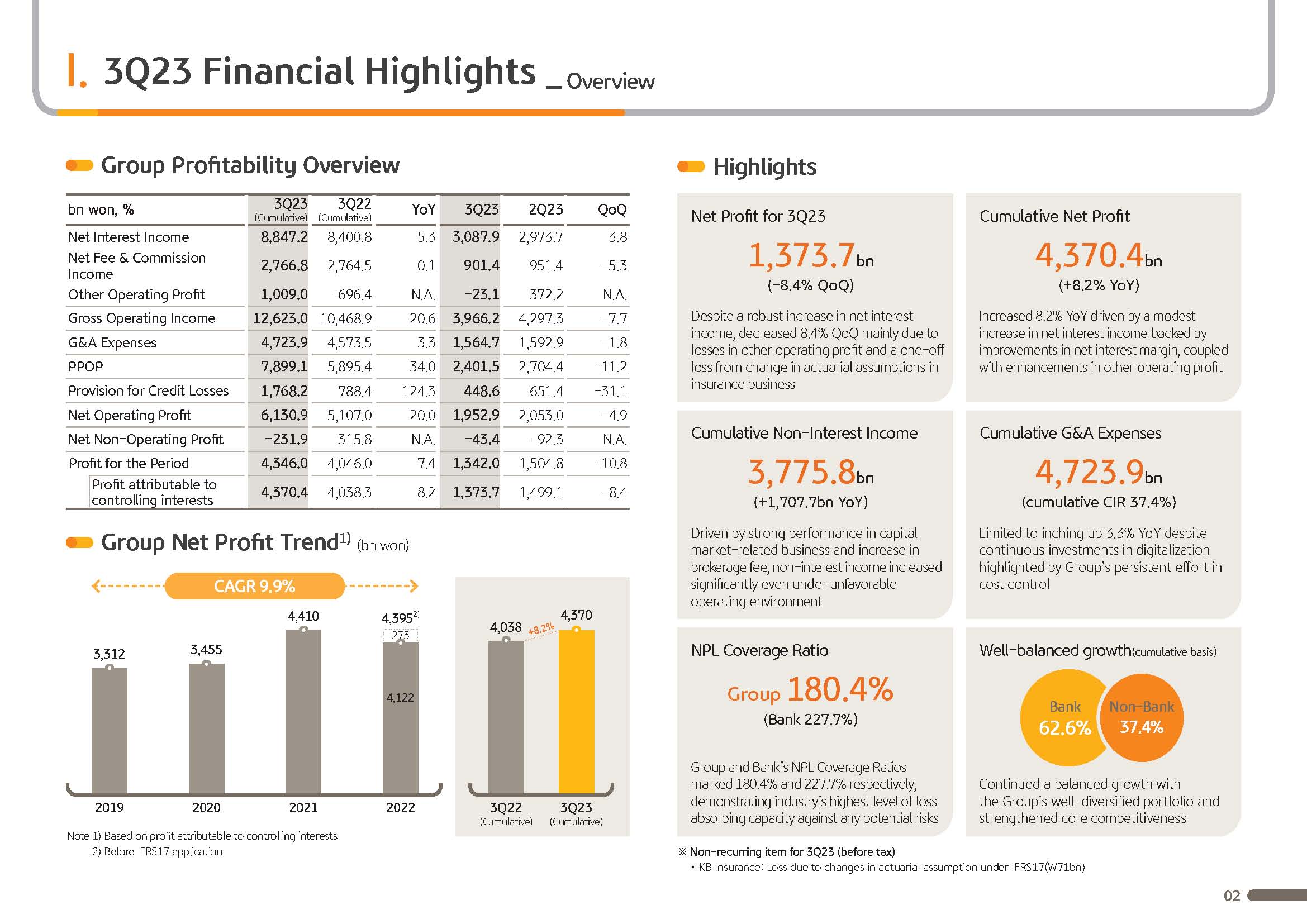

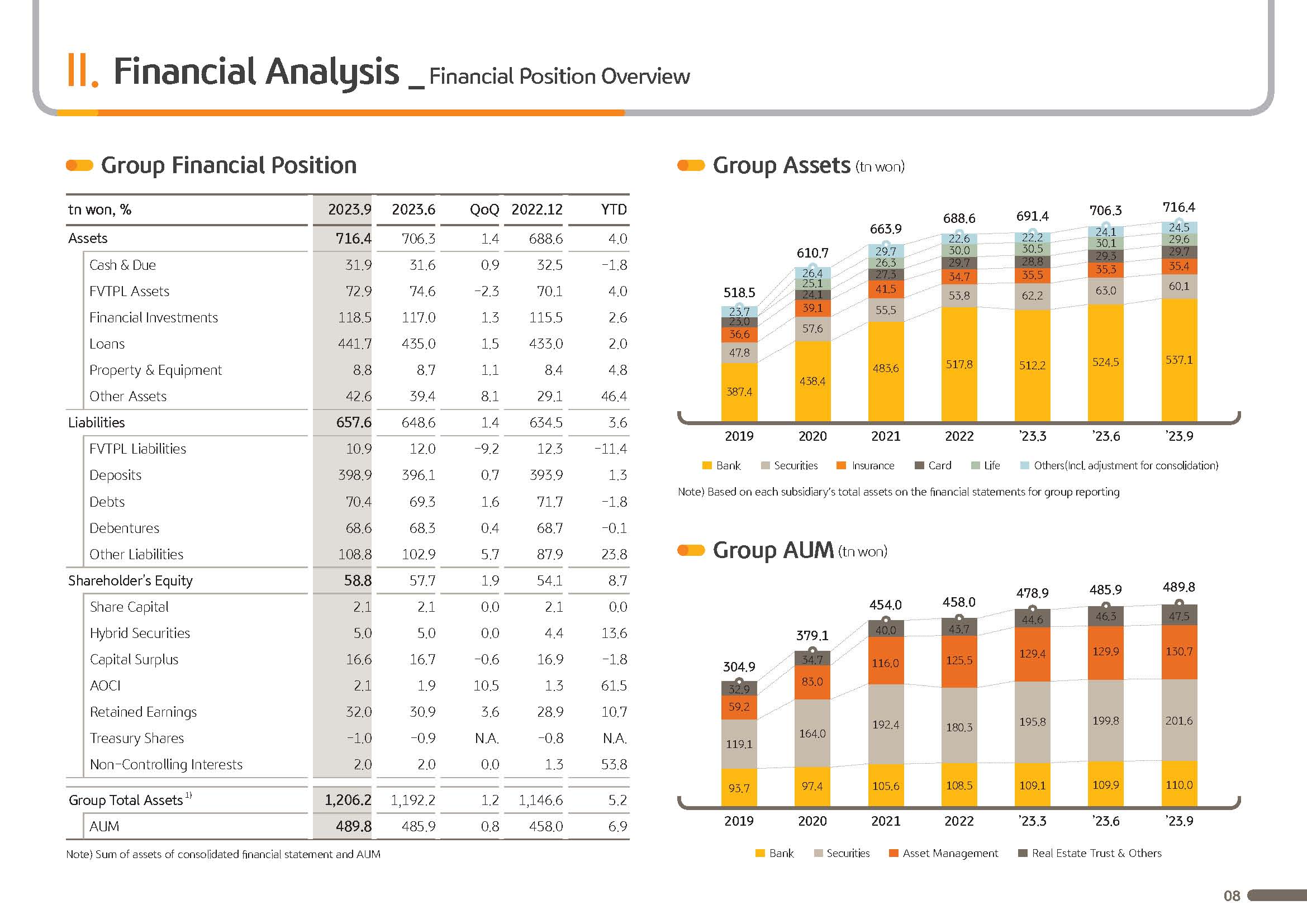

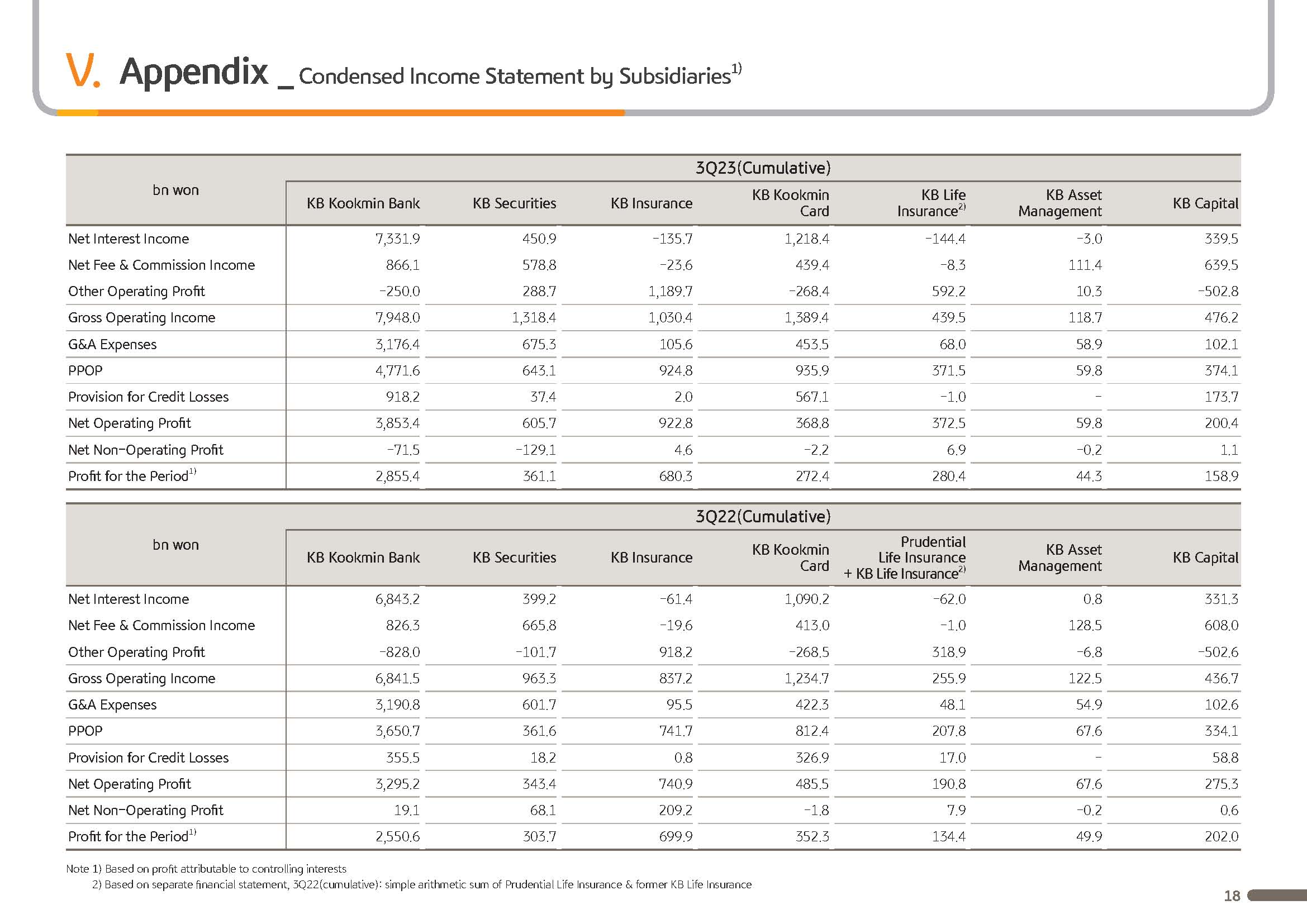

Thank you for joining KBFG's 3Q23 Earnings Presentation. Allow me to first walk through key performance metrics as of cumulative 3Q23 before going into the details on business performance. KBFG's 3Q23 cumulative net profit was KRW 4,370.4 billion, up 8.2% YoY.

Despite difficult internal and external operational backdrop supported by balanced banking and nonbanking subsidiary growth and widening of noninterest revenue and G&A control group's earnings capacity is currently well sustained.

Just to note, IFRS 17 has been retroactively applied to our 2022 earnings. Also, cumulative ROE this year was 11.7%, sustaining improvement following last year. Annualized EPS, earnings per share reported approximately KRW 14,691, up 8.3% YoY with the impact of treasury share buyback and cancellation coming through.

In Q3, net profit reported KRW 1,373.7 billion, Sound interest income growth and continuing cost savings efforts drove earnings in line with market consensus and even based on retroactive treatment of IFRS 17, there was increase in earnings YoY.

However, due to greater financial market volatilities and sizable reduction in other operating income as well as one-off losses arising from insurance subsidiaries' use of the actuarial assumption guideline of supervisors, net profit was down 8.4% QoQ.

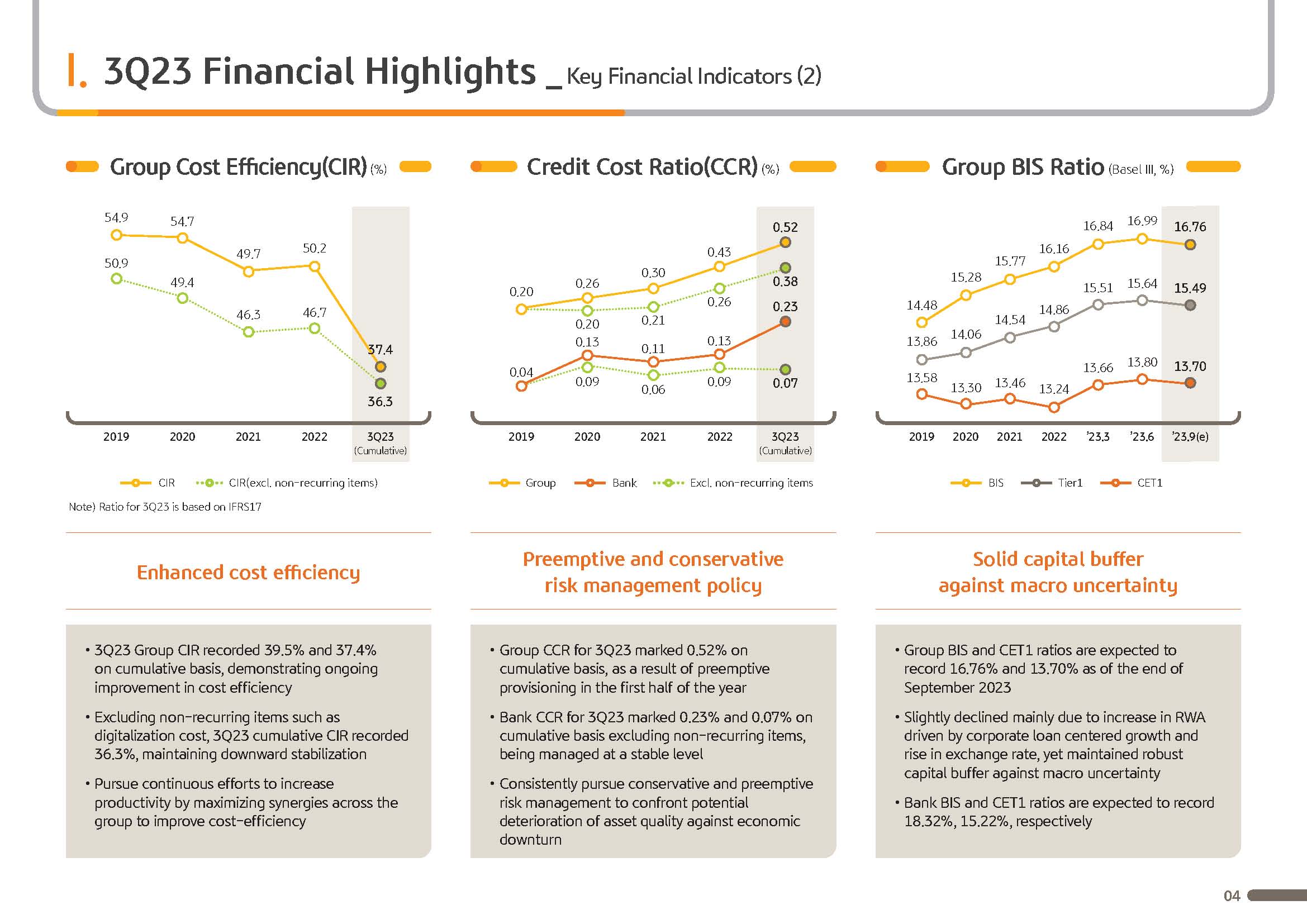

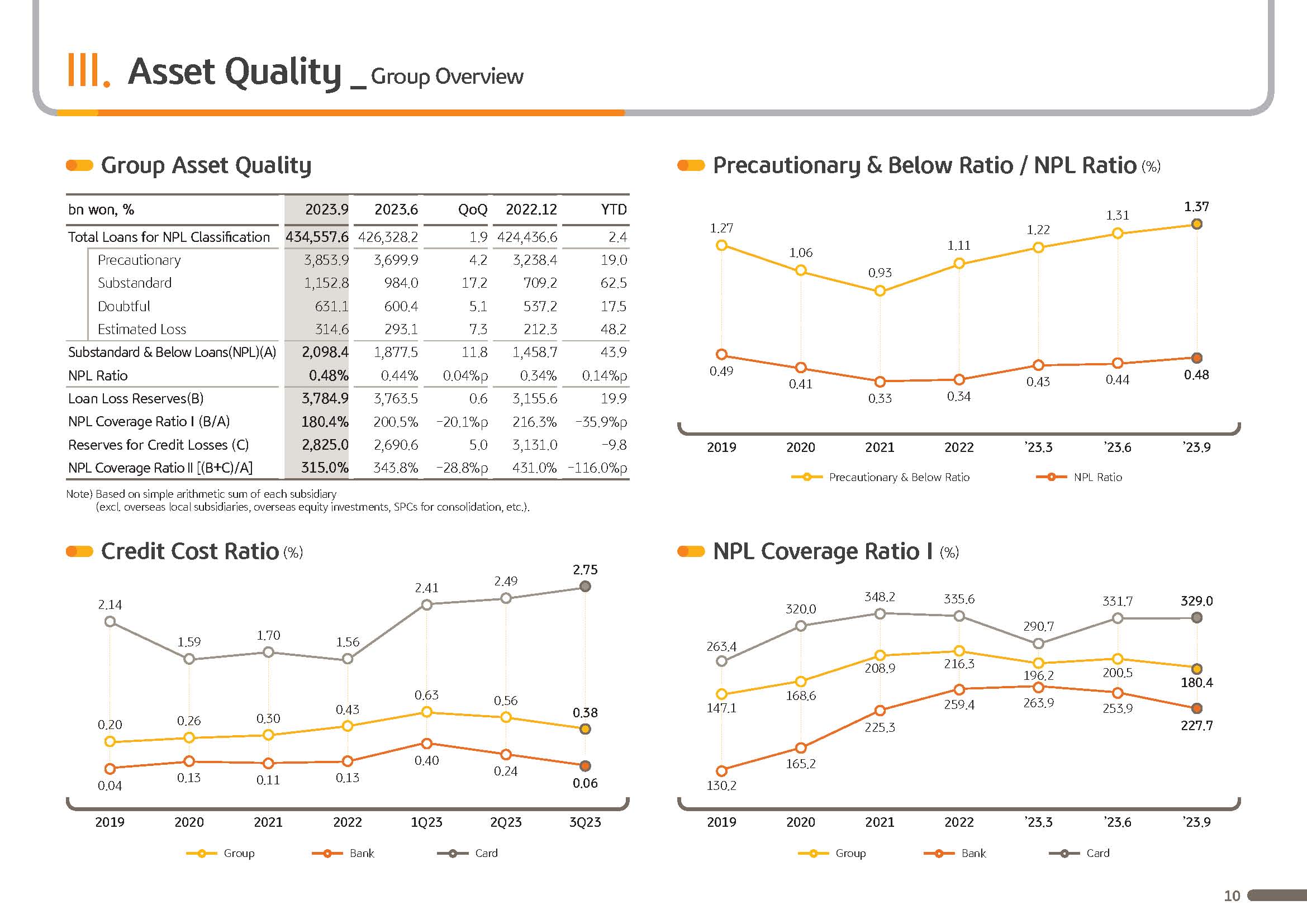

Next, credit cost on a cumulative basis for the group in Q3 was 52 basis points, reporting a wide YoY expansion. This is because on top of general provisioning during the first quarter, there was no overlay provisioning during Q2 following changes in the expected loss model, which amounted to KRW 490 billion of large-scale provisioning in the first half of the year, which was a continuation of conservative and preemptive provisioning stance against economic uncertainties at the group level.

We believe such provisioning policy will eventually have a positive impact on mitigating possible economic shock in the future and sustaining a stable net profit generation at the group level.

Also, in light of internal/external business backdrop, level of current provisioning and possibility of needing additional provisioning in the fourth quarter, full year '23 group credit cost is expected to not exceed 50 basis points. Group's NPL ratio as of end of September '23 was 0.48%, up 4 basis points versus end of June.

This is in the context of rising delinquency rate on top of which there was rise in NPLs from affiliate lending providers, real estate trust and savings bank. Nonetheless, NPL coverage ratio for the group and the bank as of end of September were 180% and 228%, respectively, attesting to ample loss absorption capacity when and if there is to be credit risk deterioration.

Lastly, today BOD of KBFG decided to payout quarterly dividend of KRW 510 per share. In terms of the update on share buyback and cancellation which was announced last July, we have been buying our shares since August under the trust arrangement and will immediately cancel the shares once the purchase is complete.

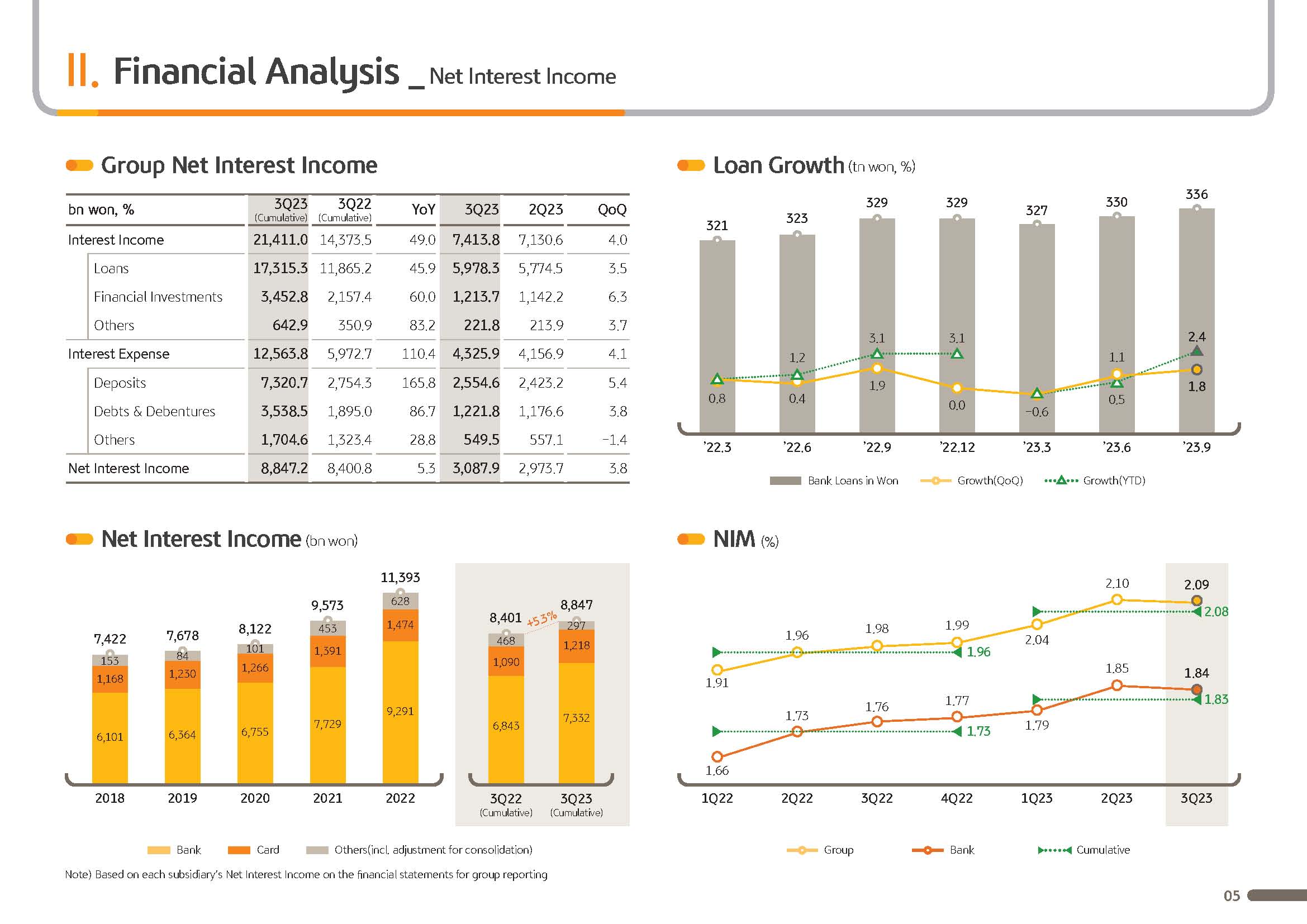

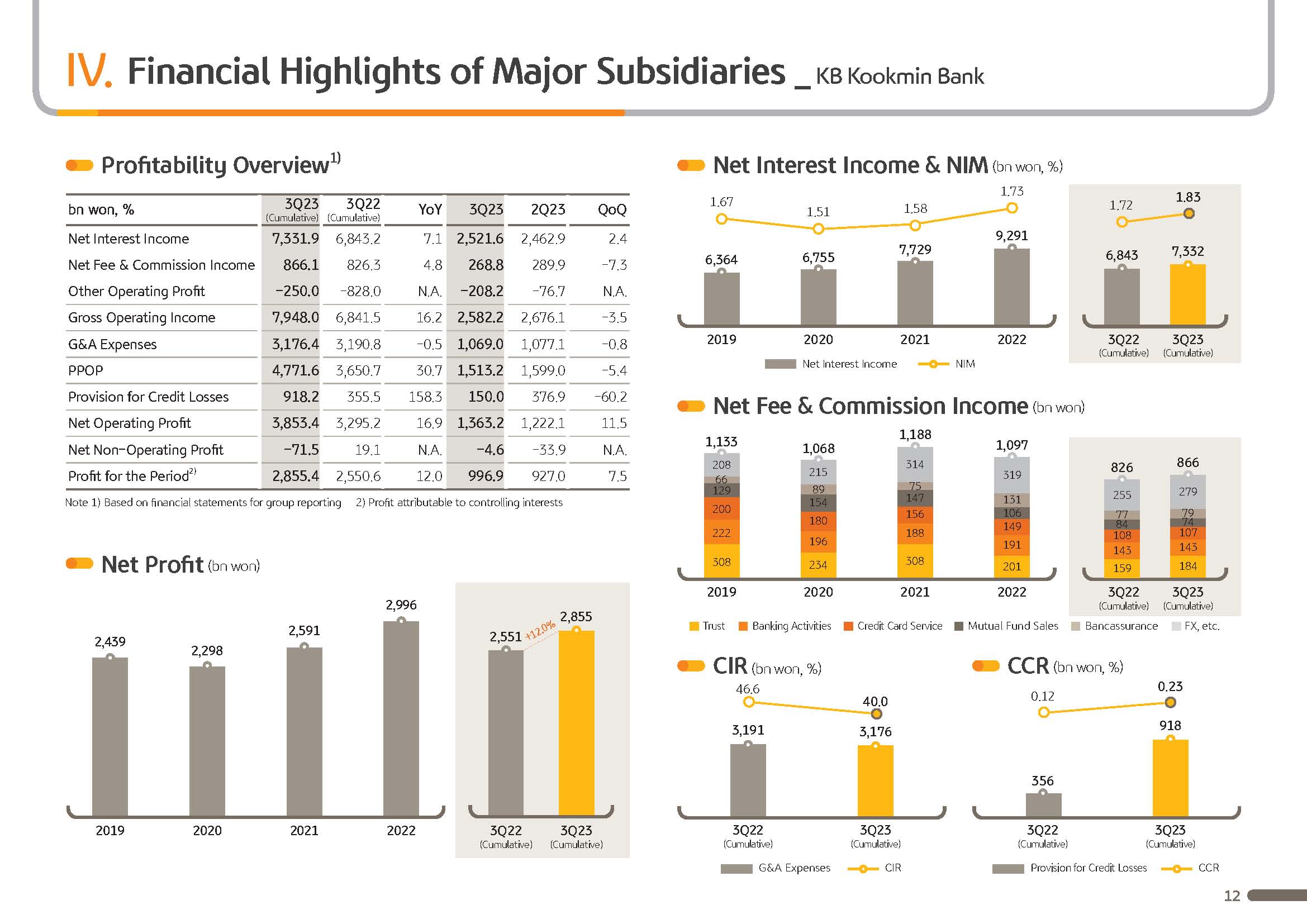

Next, I will walk through the details of the 3Q23 business results. Group's net interest income for 3Q23 was KRW 3,087.9 billion, driven by loan growth and interest income widened, posting a QoQ rise of 3.8%. Net fee and commission income for Q3 came in at KRW 901.4 billion, down 5.3% QoQ.

Even though increase in stock trading volume drove up broker fees, softer investment banking income and decline in trust fees had a dampening effect.

Nevertheless, thanks to efforts put in to diversify group's business portfolio, net fees and commission income this year had been around KRW 900 billion level on a quarterly basis which goes to show enhanced capacity of the group in generating its fee income.

Next is other operating profit, which includes income from prop trading and insurance operations. In Q3, there was other operating loss of KRW 23.1 billion on the back of higher market rate and rising won/dollar exchange rate, which led to somewhat of a muted performance of securities, derivatives and FX currency operations.

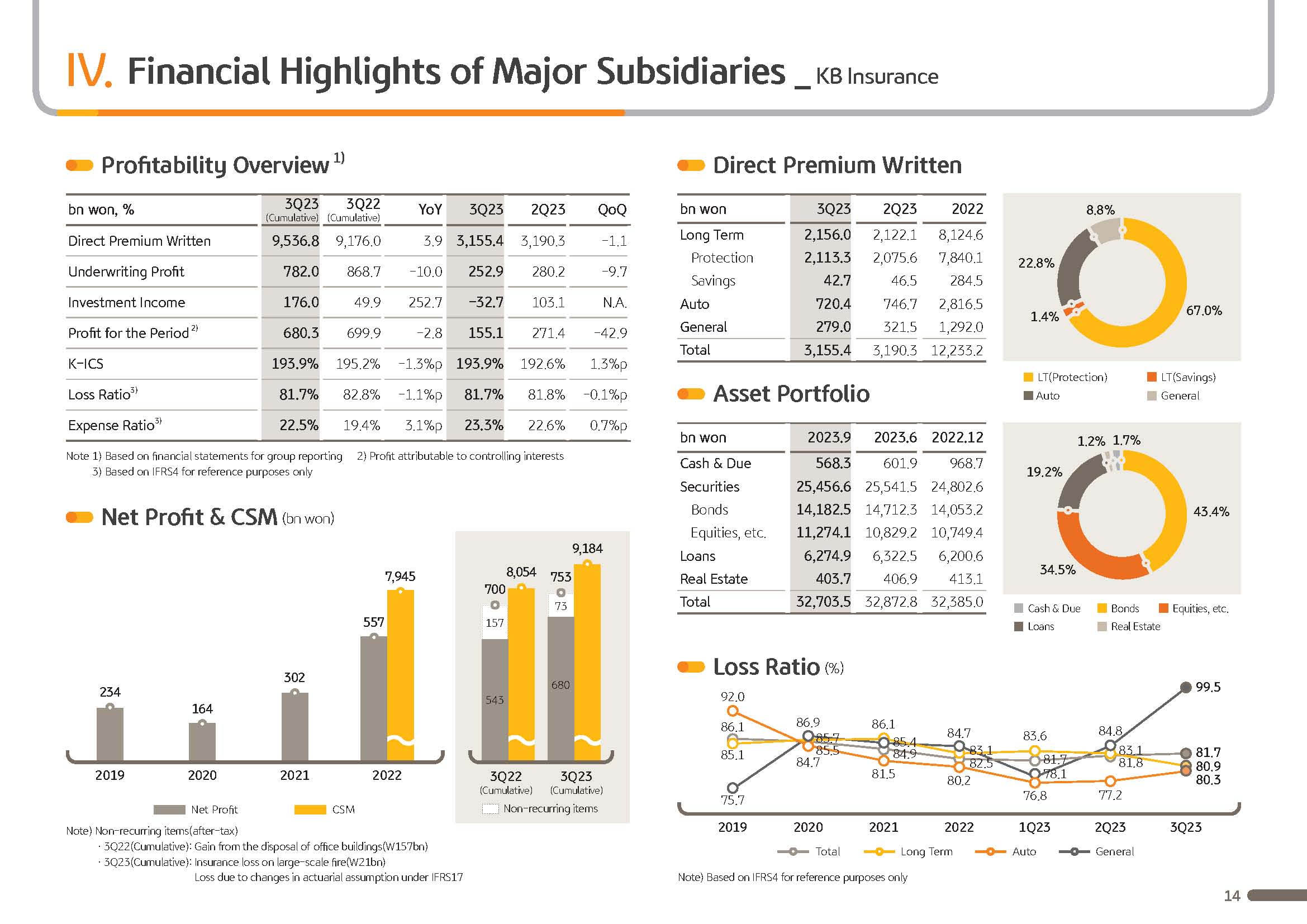

For the insurance business, with the application of supervisory guideline on actuarial assumption, including changes in loss ratio for medical indemnity product for the P&C insurance, there was a one-off loss of around KRW 71 billion.

However, excluding such one-off loss this quarter, net profit of KB Insurance in Q3 is above KRW 200 billion, which is quite steady, even considering second half seasonality seen in the non-life insurance industry, while the company's market dominance is widening, pivoting on long-term protection insurance.

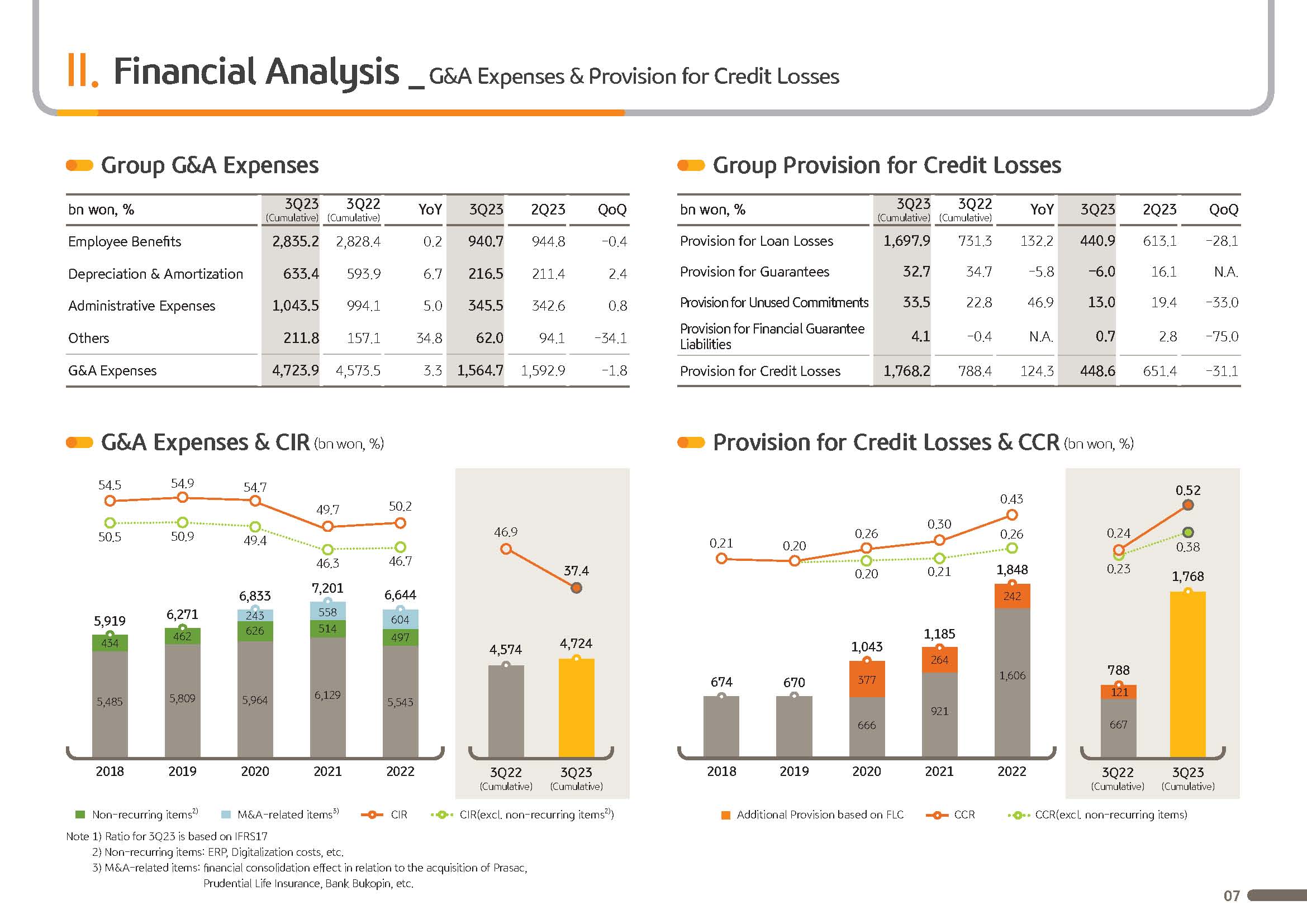

Next, I would like to cover G&A expenses.

Q3 G&A expenses posted KRW 1,564.7 billion and through continuous cost rationalization efforts, it went down slightly QoQ. On the other hand, Q3 cumulative group CIR posted 37.4% and nominal CIR and recurring CIR, excluding nonrecurring items, all greatly improved YoY.

Group CIR is showing a market downward trend, thanks to solid top line growth and results from continuous cost efficiency efforts. Our goal is to achieve a mid- to long-term annual CIR target of early 40% range, and we forecast that 2023 full year CIR will be managed within our target range.

Lastly, group provision for credit losses.

Q3 provision for credit losses posted KRW 448.6 billion and decreased greatly QoQ due to the additional provisioning underlying effect in Q2.

Since we have been continuing a conservative provisioning policy until now and have been securing a buffer preparing for external internal uncertainties, we find that there is a limited possibility for the group's credit cost to rapidly increase going forward.

There have been recent concerns regarding financial company's asset quality. And in order to prepare for these possibilities preemptively, we will do our best to manage asset quality by strengthening management of potential nonviable exposure and by maintaining our conservative risk management stance.

From the next page, I'll cover our major financial highlights.

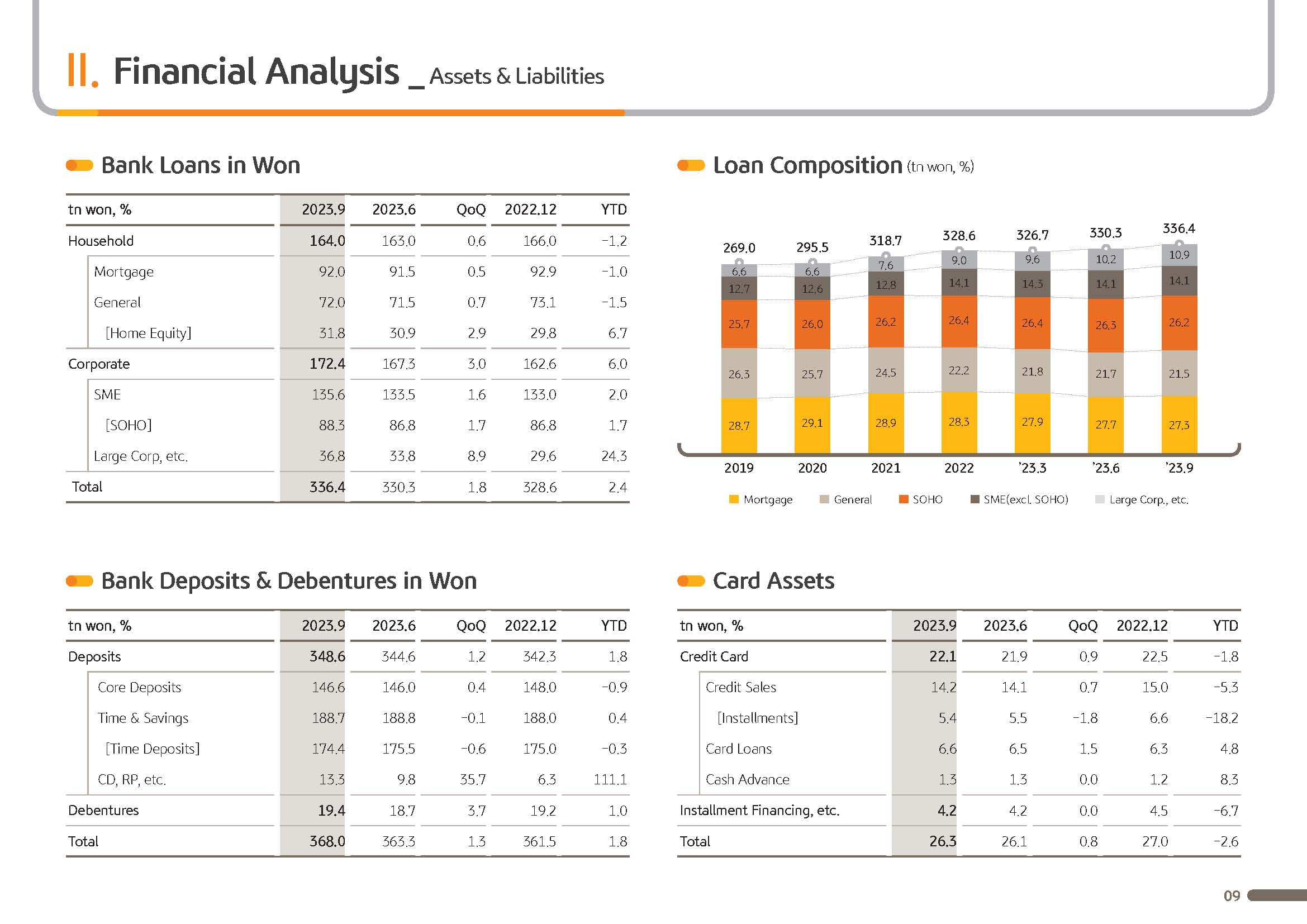

First, looking at the bank loans in won growth graph, bank loans in won as of end September 2023 posted KRW 336 trillion, and increased 1.8% compared to late June and 2.4% YTD. Corporate loans posted KRW 172 trillion, and increased around KRW 5 trillion compared to late June and is leading loan growth.

This was due to the deterioration in the corporate bond insurance market and with the increase of overall loan demand, large corporate loans increased 8.9% compared to end June and SME loans increased 1.6% compared to end June.

Household loans posted KRW 164 trillion and with increased demand following the real estate recovery trend centering on mortgage loans and Jeonse loans, it has increased by 0.6% compared to late June and reduced negative growth.

Amidst of spreading internal and external uncertainties in order to focus on qualitative growth based on high-quality assets, we have been continuing rebalancing for potentially nonviable loans and maintaining a conservative loan policy.

Next is net interest margin NIM.

3Q23 group and bank NIM posted 2.09% and 1.84%, each, respectively, and went down 1 bp QoQ. This was mostly due to the increase of funding burden centering on time deposits and marketable deposits according to the loan growth recovery amid the decreasing trend of the loan asset repricing effect, which had been leading the NIM improvement trend.

On the other hand, regarding 2023, Q4 NIM, despite the continuous downward pressure, including continuing funding burden and contraction in the net interest spread we expected to maintain a level not greatly different from the Q3 level.

Next, let's go to the next page.

I would like to elaborate on the group's capital ratio on the upper right-hand side. Estimated group BIS ratio as of late September posted 16.76% and CET1 ratio posted 13.70%, respectively. With corporate loan focused growth, risk-weighted assets relatively greatly increased, won weakening of KRW 32 per $1 in the quarter led to a negative effect on RWA management, which all caused a slight decline in BIS and CET1 ratio compared to late June.

However, we are still maintaining a higher CET1 ratio level among the bank financial holdings companies.

From the next page, we have details regarding the performance I have been covering, so please refer to if needed. With this, I will conclude KBFG's 3Q23 business performance report. Thank you for listening.