-

Please adjust the volume.

2024 Business Results

Greetings.

I am Peter Kwon, Head of IR.

We will now begin the 2024 full-year Business Results Presentation.

Thank you very much for participating in today's earnings release.

At today's earnings release, we have here with us executives from the group, including Managing Director and CFO, Sang Rok Nah.

First, our Group CFO will cover 2024 major earnings results. And after that, we will engage in a Q&A session.

Please note that from this presentation after our real-time Q&A session, we have set aside additional time for the management team to answer questions that were previously submitted by our shareholders to our website.

I will now invite our group CFO to walk us through 2024 full-year business results.

Good afternoon. I am Na Sang Rok, CFO of KB Financial Group. Thank you all for joining KBFG's earnings presentation for FY 2024.

Before going into earnings results, I will first run through business highlights. As concerns over household debt and the real estate persisted in 2024, recent financial market volatilities expand on the back of major countries' monetary policy stance, the US presidential election, and surge in the FX rate.

For banking, in particular, rate cut cycle eroded profitability and there were rising concerns on asset quality due to a slump in real economy and ELS related compensation booked at the start of the year exerted a downward pressure on bottom line.

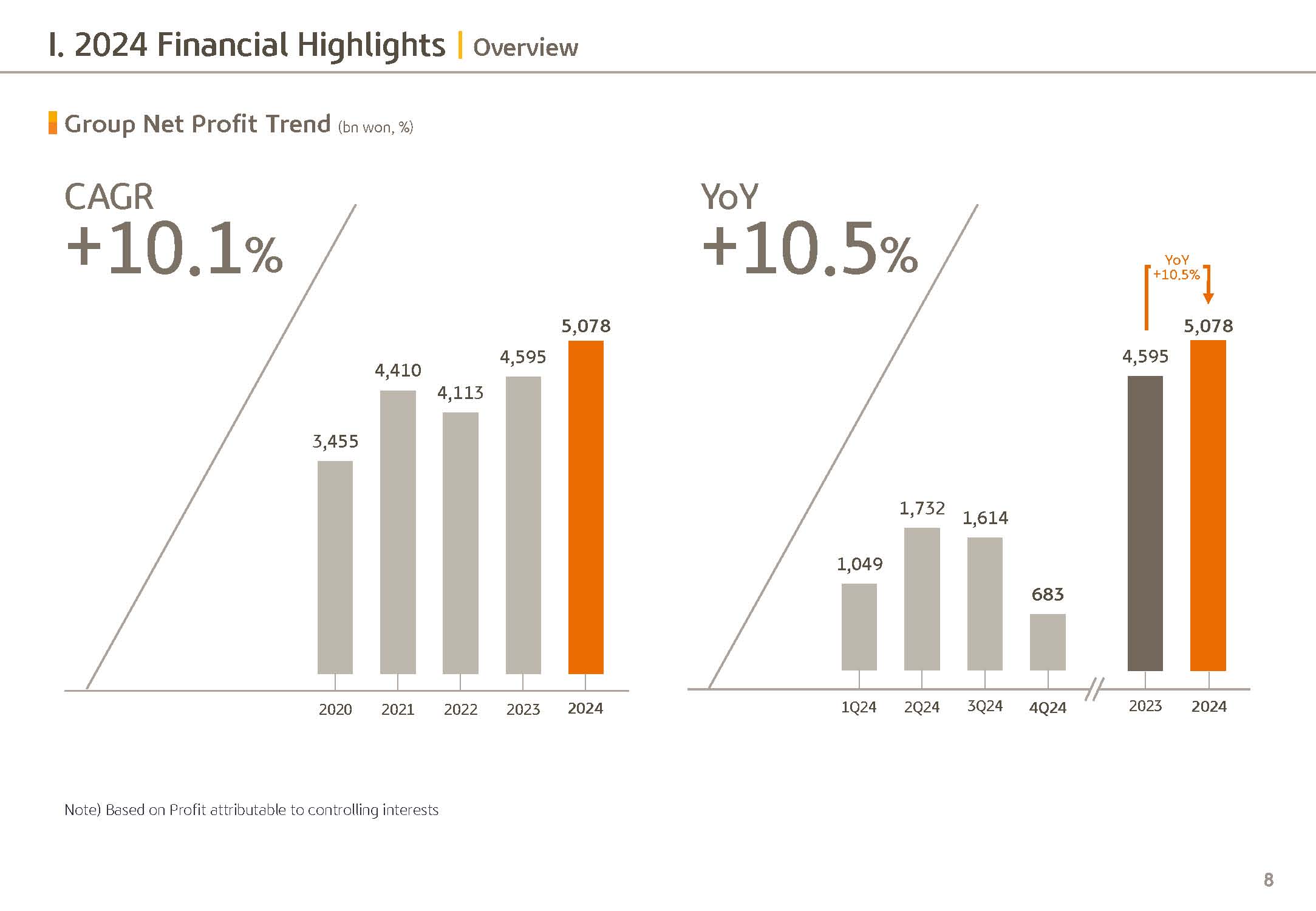

Despite all this, net profit for the year reported more than KRW 5 trillion, sustaining a solid profit uptrend for the group.

These results are meaningful and that despite a structural difficulty of profitability declines, concerns on soundness, and heightened economic uncertainties, our fundamentals have proven solid on the back of business portfolio diversification efforts that we've placed over the years.

Also, 2024 can be regarded as the inaugural year of value-up as we placed emphasis on sustainability and predictability based on which we announced sustainable value-up plan last October embodying KB's philosophy, which was met with positive market reaction.

We were the first to implement share buyback and cancellation in the sector and introduced equal quarterly dividend distribution based on total payout, which shows KBFG is leading market in shareholder return and has continued to develop such policies, thereby laying a fertile ground.

Underpinned by this foundation, I would like to emphasize yet again that we will implement KB's value-up plan firmly with no interruptions.

From next page onwards, I will walk through KBFG's performance highlights for 2024.

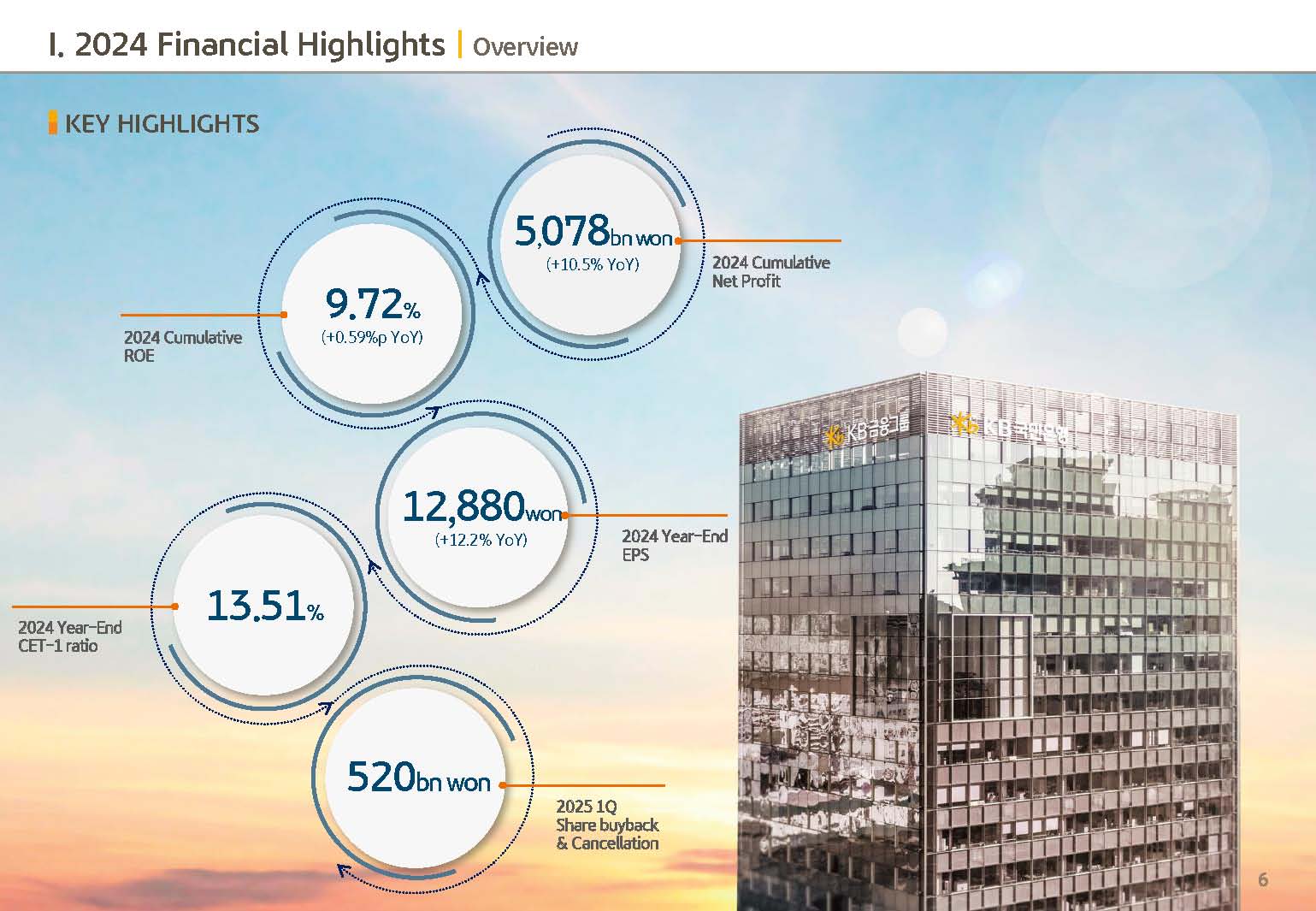

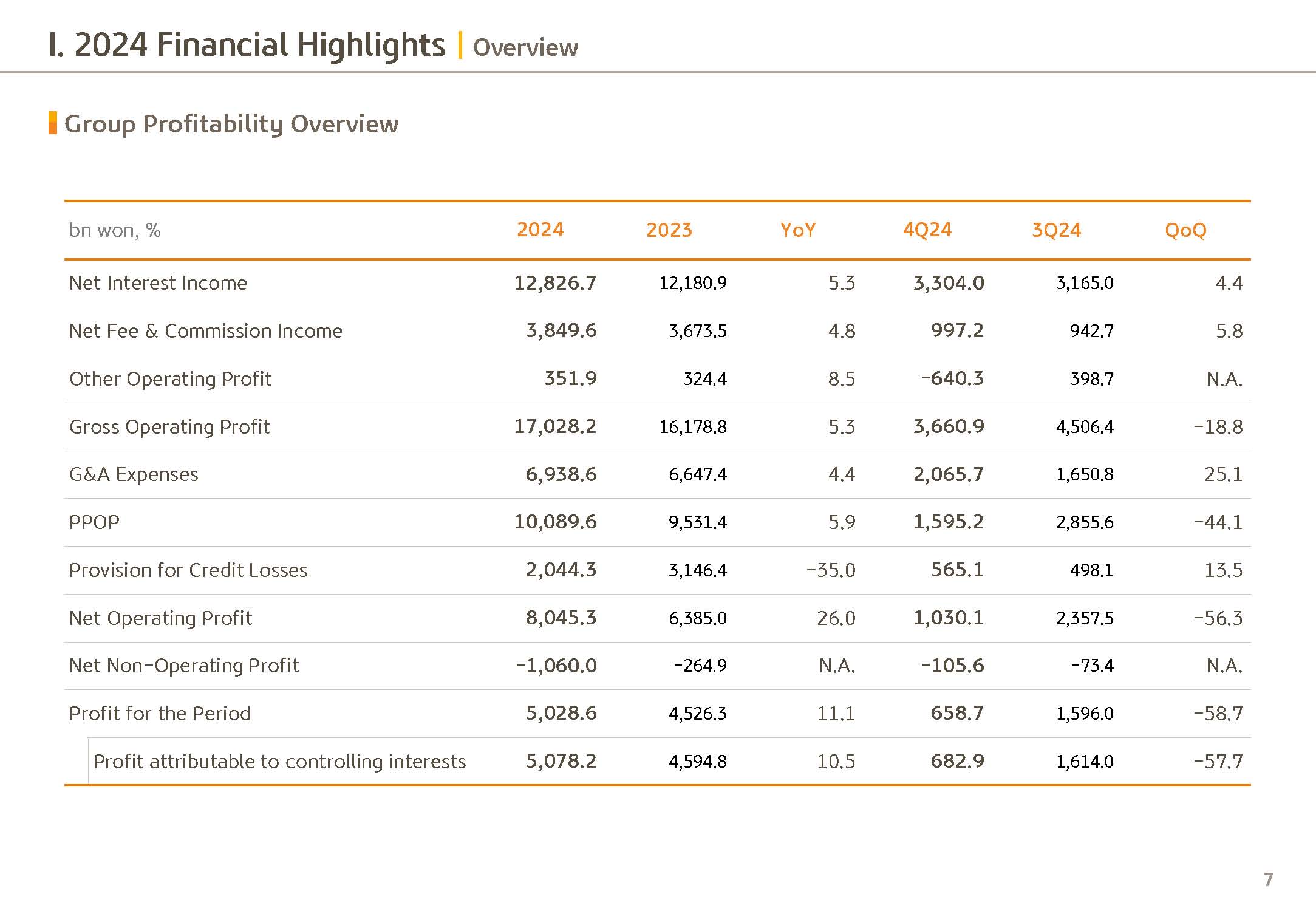

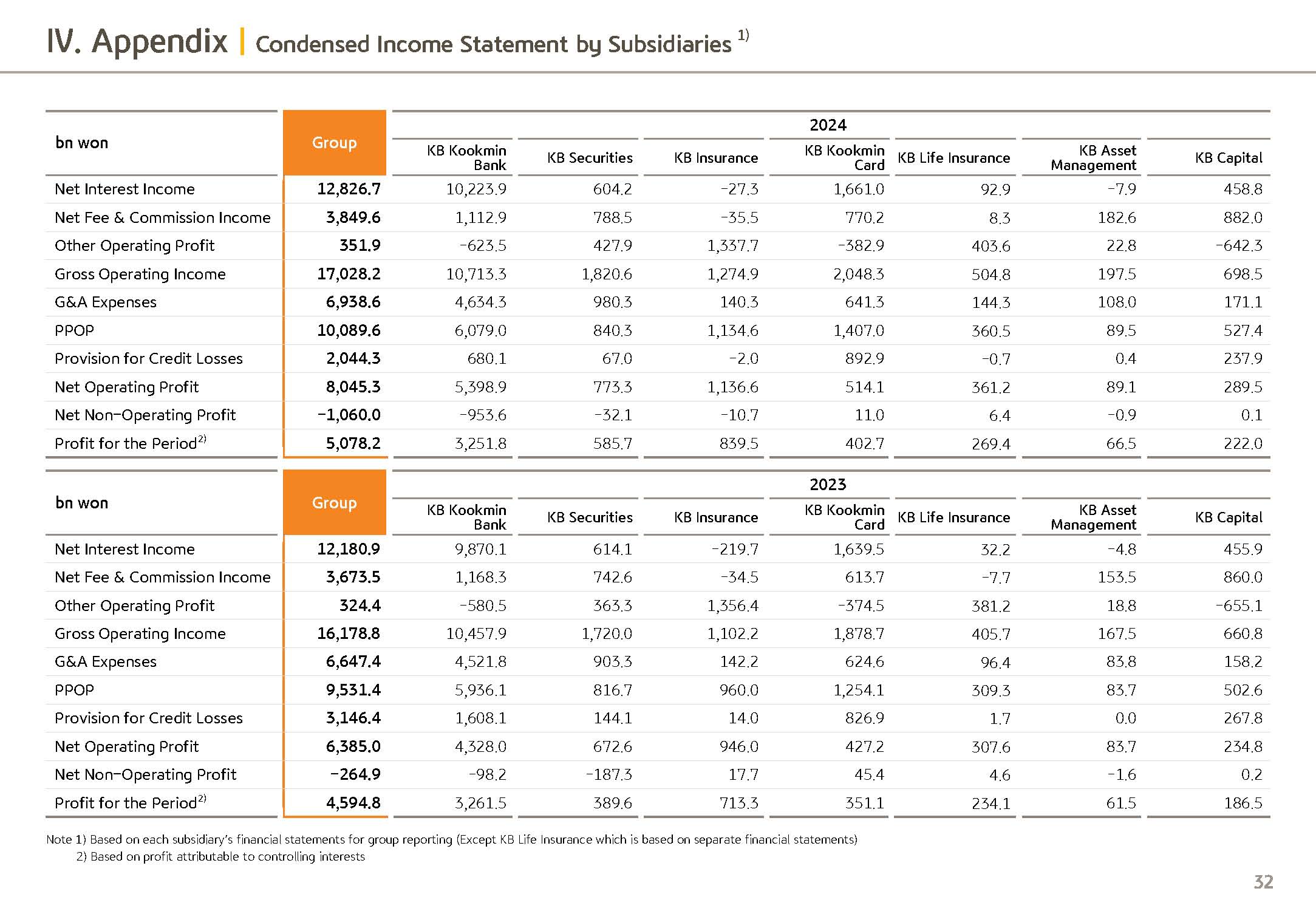

Firstly, KBFG's FY24 net profit was KRW5,078.2 billion, driven by balanced top-line expansion across all domains, reporting 10.5% year-over-year increase.

If you look at pre-provisioning operating profit for '24, it came in at KRW10,089.6 billion, up 5.9% year over year. And compared to FY21, nearly three years back, this is around 38.5% expansion attesting to solid earnings capacity of the group.

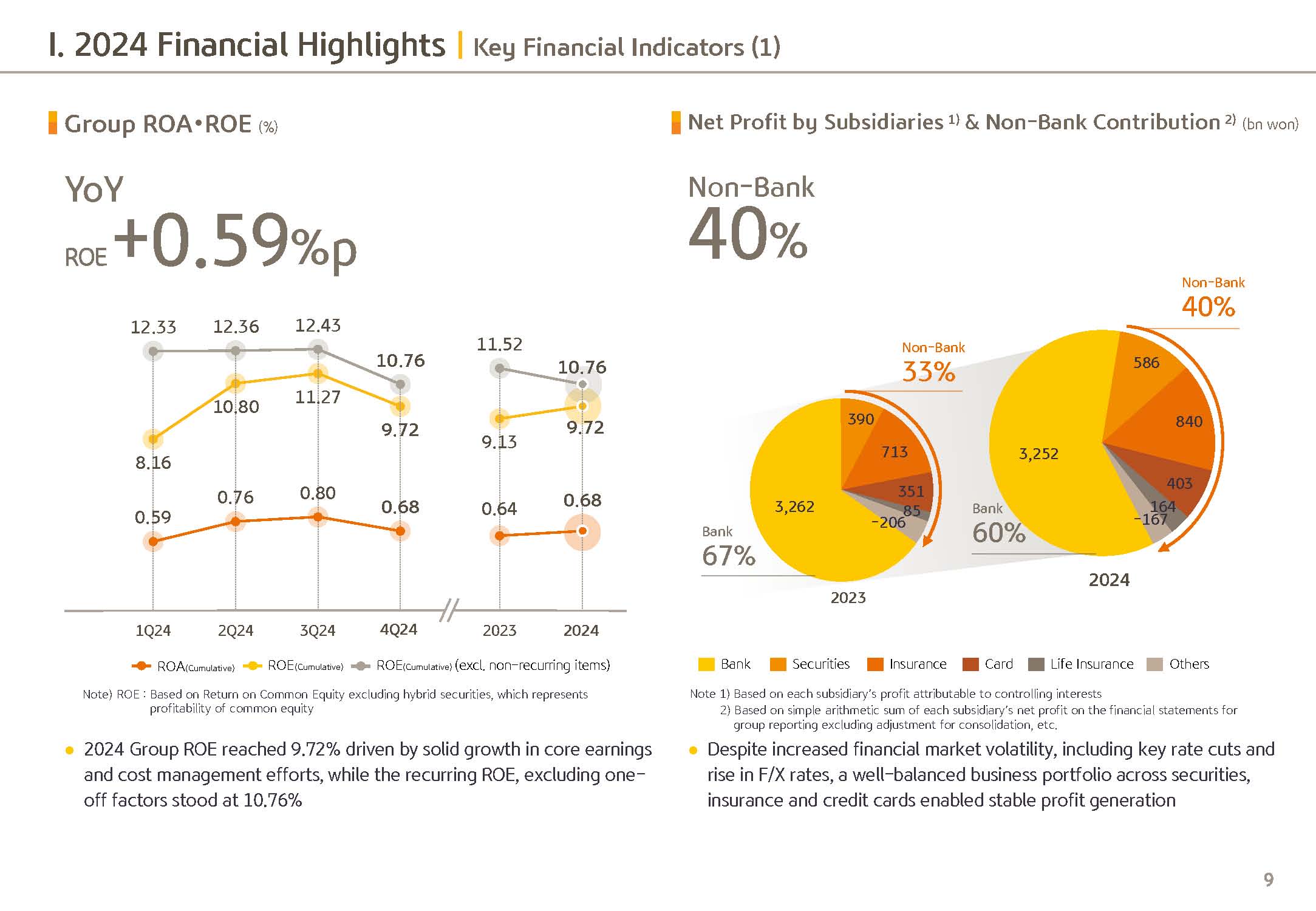

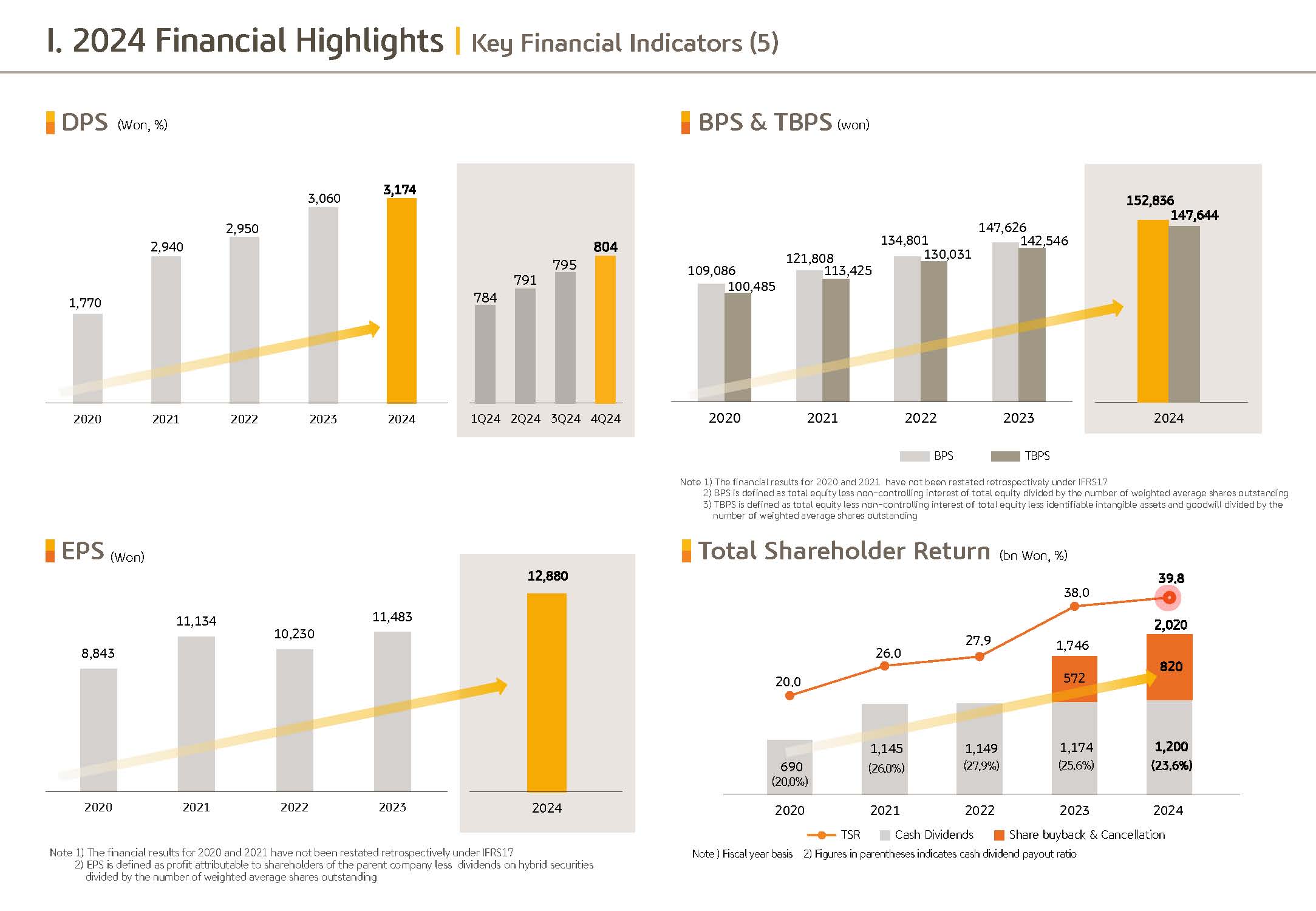

Also, ROE for 2024 recorded 9.72%, improving 0.59 percentage points year over year, while EPS was KRW12,880, up 12.2% year over year.

Meanwhile, due to sizable one-off expense, including ERP cost and decline in gains from securities, derivatives, and FX following rise in FX rate and equity price falls as well as contractions in insurance earnings impacted by seasonality, net profit for Q4 recorded a QoQ decline by a large margin.

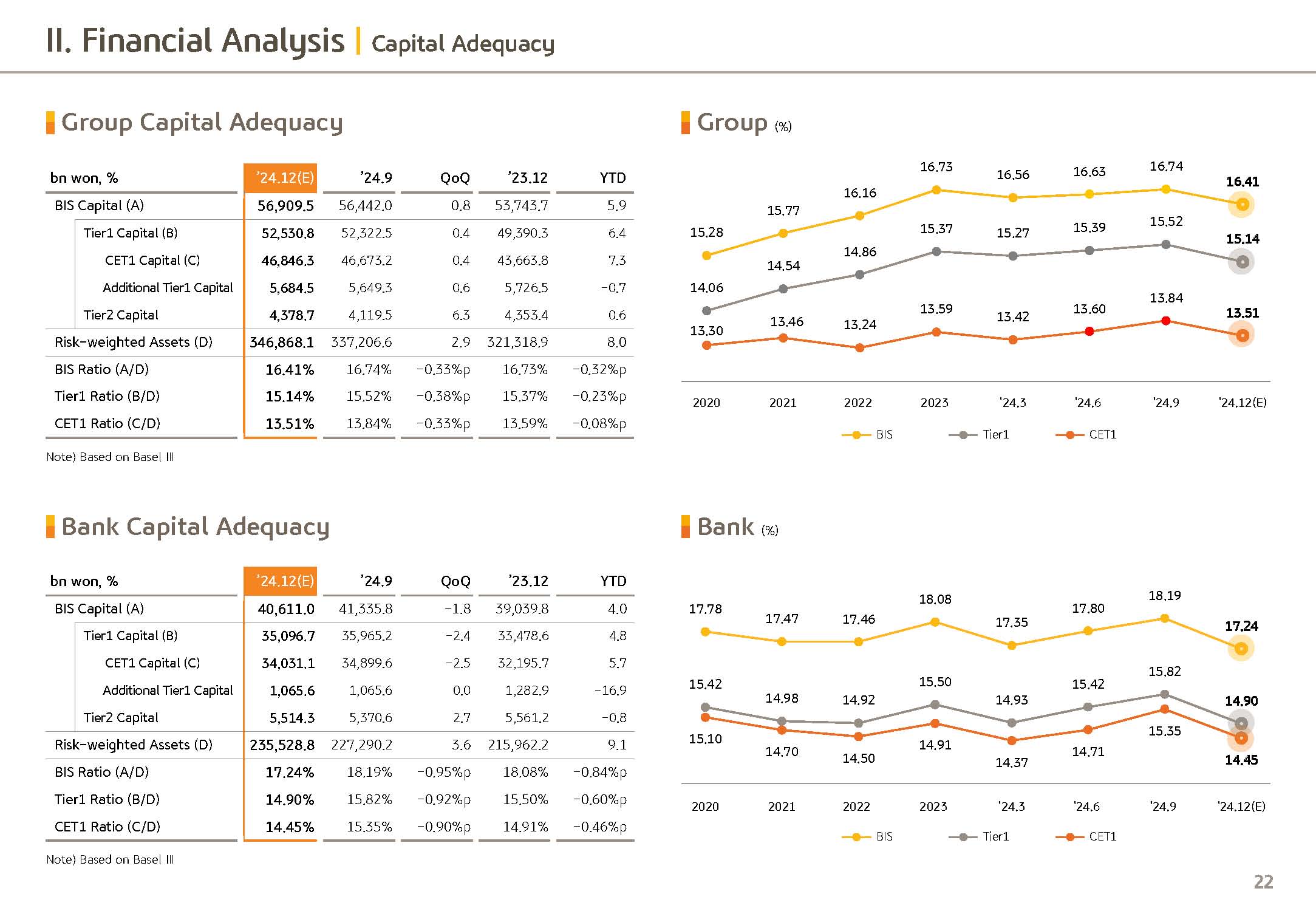

Next, we expect KBFG CET1 ratio as of December end '24 to be 13.51%.

Although CET1 ratio dipped somewhat QoQ on the back of profit contraction in Q4 following FX fluctuation and slow seasonality, we were able to maintain stable asset growth whilst still maintaining a mid-13% level, which is industry's top tier.

I will elaborate on CET1 on the following pages.

Let me also talk about resolution on shareholder return made by the Board of Directors today. KBFG's BOD today decided on a total of KRW300 billion cash payout with DPS of KRW 804.

DPS, including the paid dividend in 2024 amount to KRW 3,174, which is an increase of around 3.7% year over year. Do note that total yearly dividend payout of KRW 1.2 trillion and KRW 820 billion of share buyback and cancellation during the year will amount to TSR of 39.8% for FY24. The BOD today also resolved on KRW 520 billion of share buyback and cancellation as well.

In accordance with our Value-Up framework that aligns TSR to CET1 ratio based on year-end CET1 ratio of 13.51%. Capital in excess of 13%, which equals approximately KRW1.76 trillion was used as resources for cash payout for '25 and first half share buyback and cancellation.

For your information, we are looking at a slight year-on-year increase in total cash payout in 2025 by around KRW 40 billion, but nothing has yet been confirmed. Once the BOD decision is reached, we will make appropriate disclosure in due time.

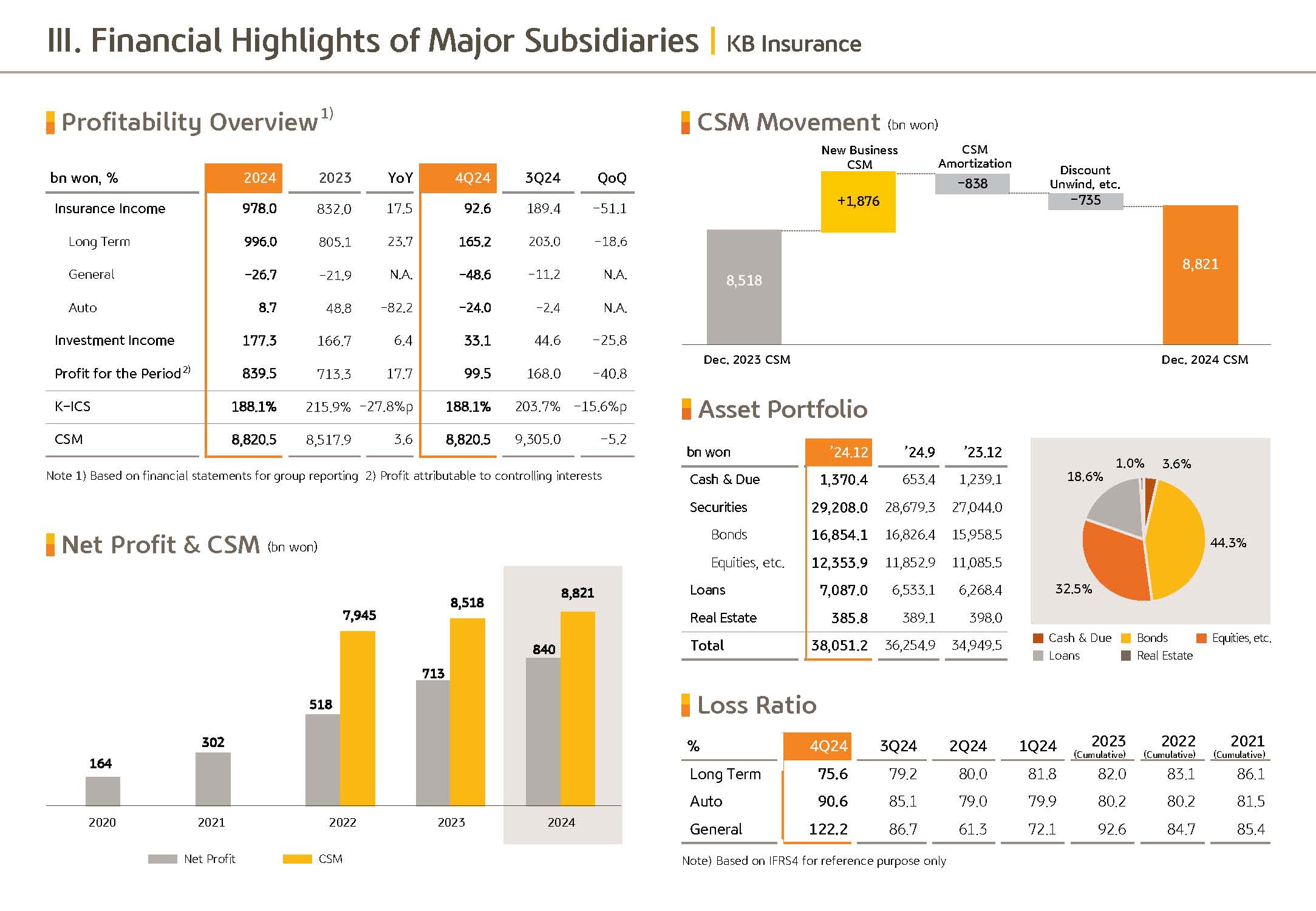

Next, moving on to breakdown and details of the earnings results. In Q4, in accordance with supervisors' interpretation and accounting rules, insurance subsidiaries, including KB Insurance and KB Life applied changed accounting rules in relation to experience variance and expiring contract and Q4 '22 and Q4 '23 earnings have been restated retrospectively for your reference.

The main lever behind group's top-line performance in '24 was bigger and sustained profit contribution from nonbank portfolio, defining solid earnings enhancement of the group.

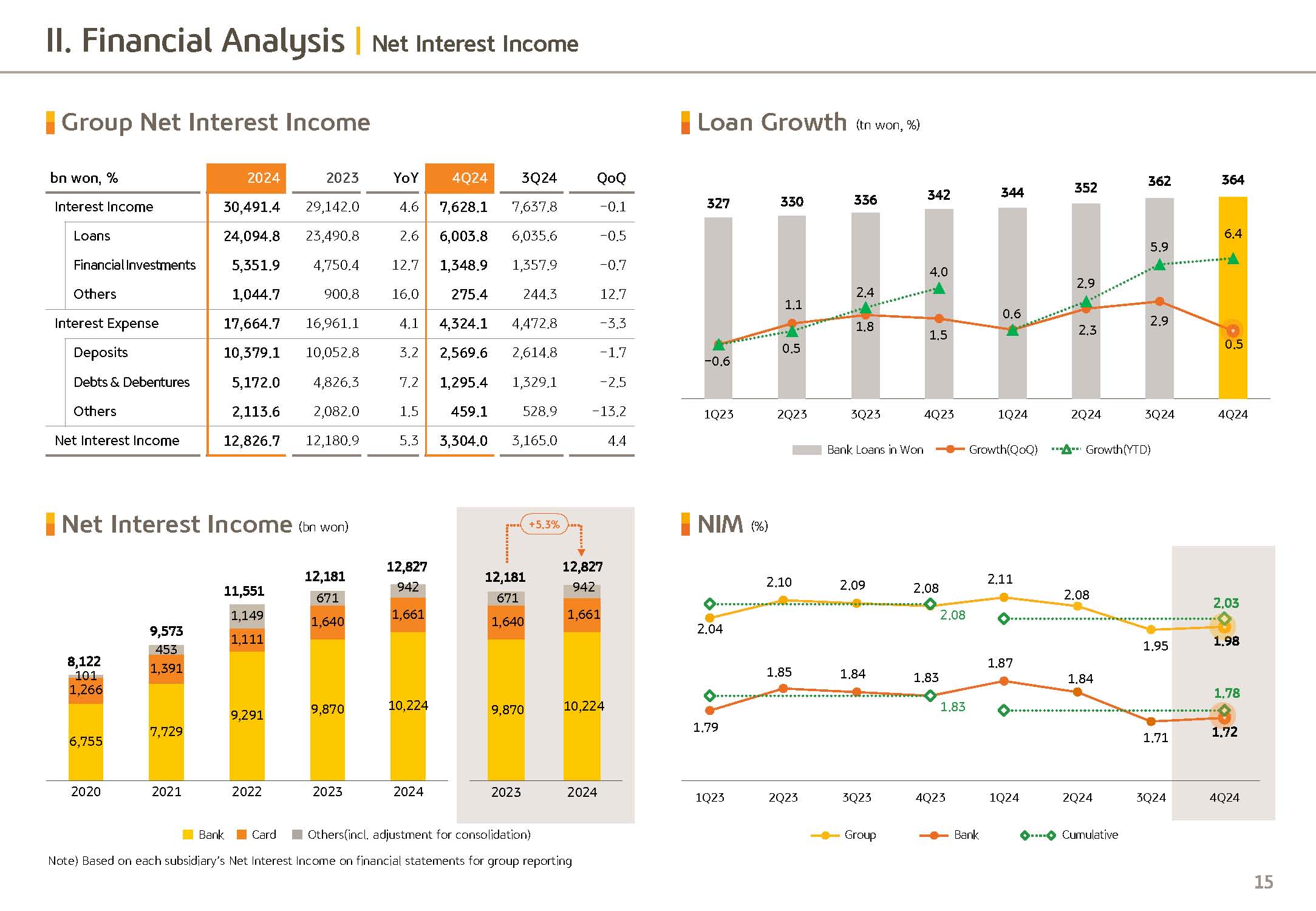

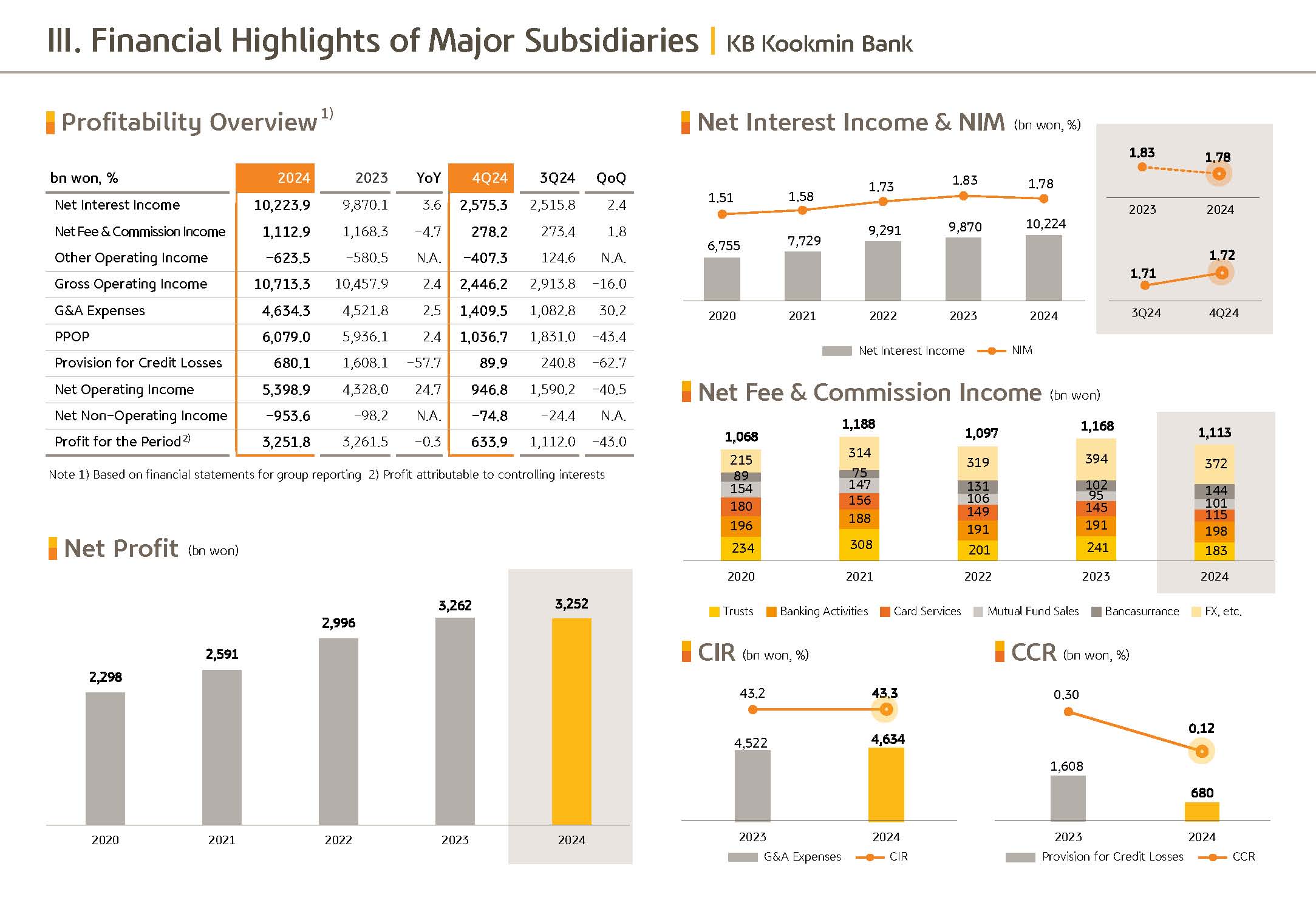

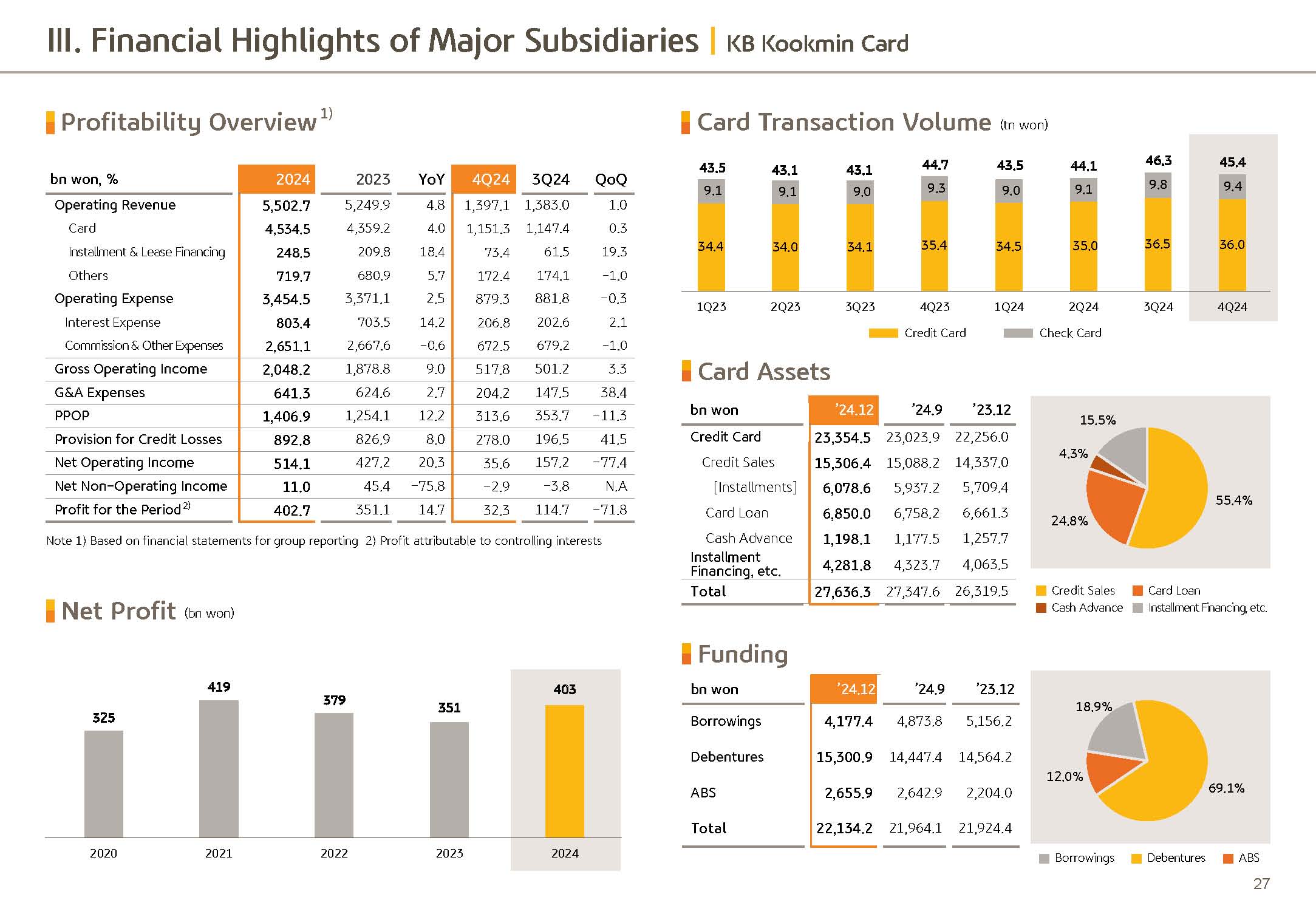

Firstly, in 2024, group NII was KRW 12,826.7 billion, up 5.3% year over year. Despite NIM moving downwards on the back of rate cut expectations, loan demand rose, expanding the bank's average loan balance, while interest income contribution from non-bank subsidiaries from credit cards and insurance continued to rise.

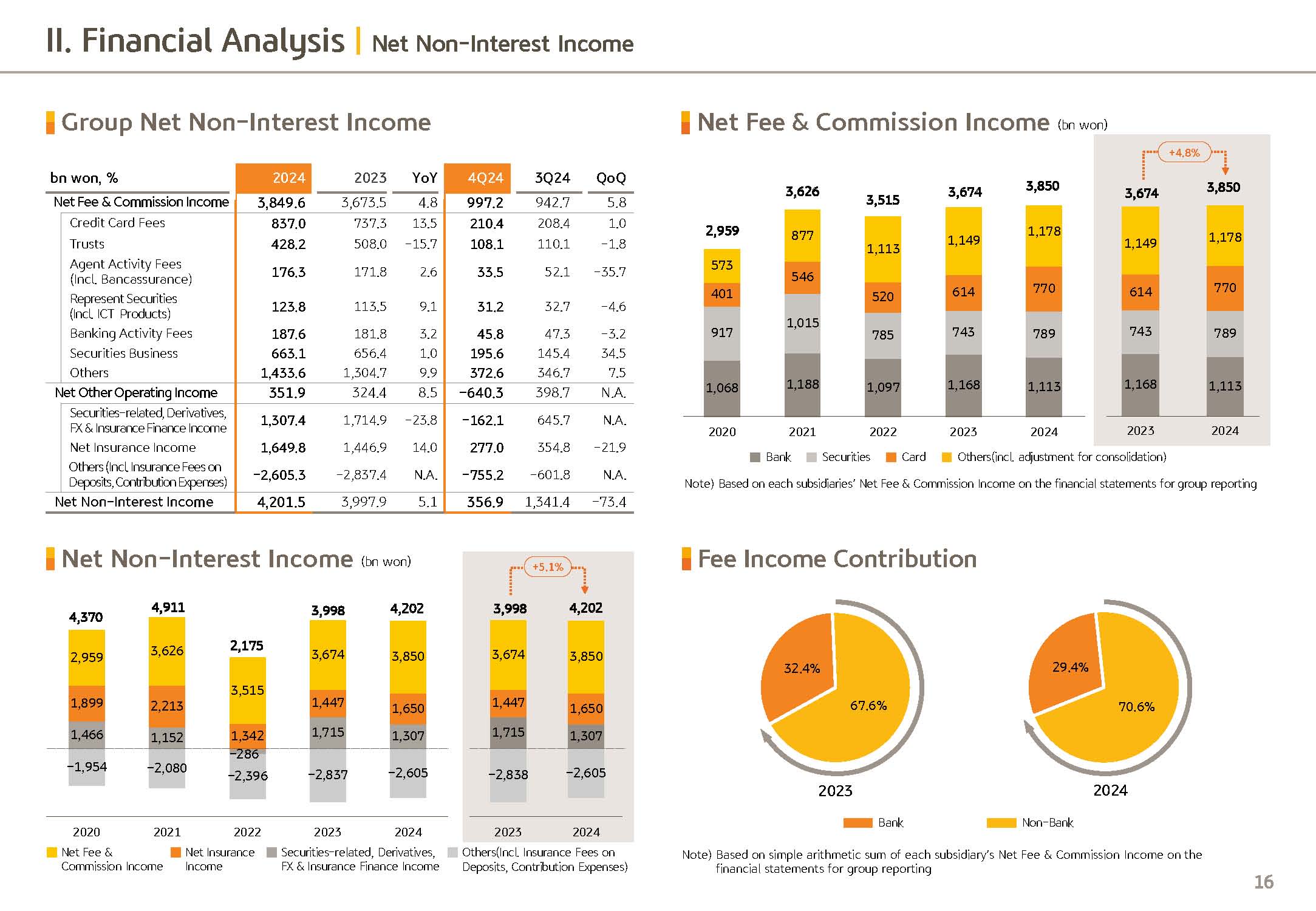

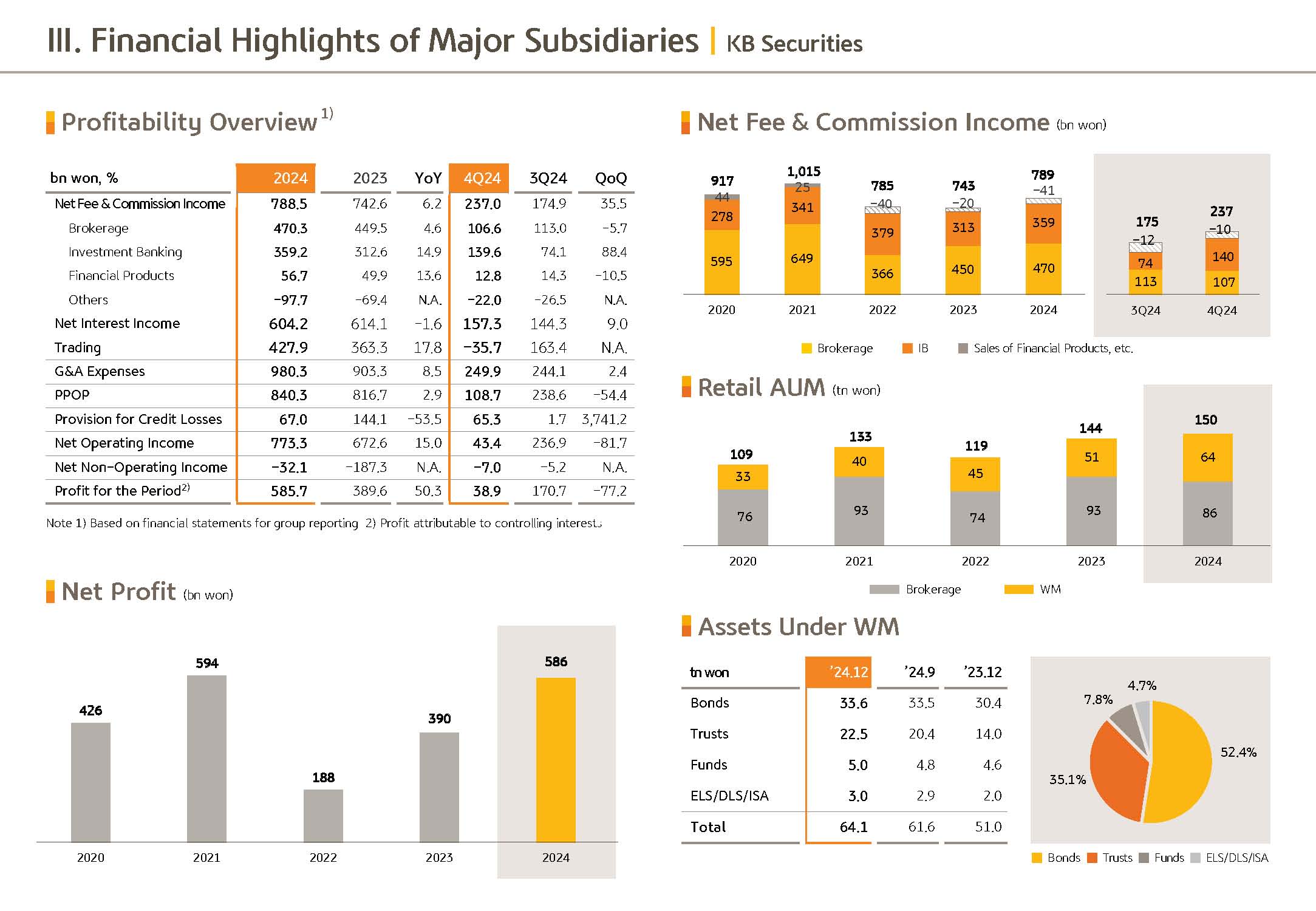

Group's net fee and commission income in FY24 reported KRW 3,849.6 billion, up 4.8% year over year or around KRW 176.1 billion. Now this is despite suspension of ELS sales and depressed real estate PF market, which pushed down the bank and real estate trust fee income. Rather on the back of increase in credit card merchant fees and cost efficiency gains, credit card fee income posted a whopping KRW 99.7 billion increase year on year.

Also with higher securities business net fee income from investment banking and steady lease fee income at the KB Capital, enhanced fee income across nonbank subsidiaries were key levers.

Worth noting is fourth quarter net fee and commission income at KRW 997.2 billion despite a decline in merchant fees following shortened acquiring cycle and decline in stock trading volume and other market headwinds, securities made bigger contribution through acquisition financing, IPO, real estate PF, and other IB's fees, driving 5.8% growth Q over Q.

Next, 2024 other operating profit posted KRW 351.9 billion. And with the fading of the base effect from the previous year's bank social contribution program costs, it increased 8.5% YoY.

However, Q4 other operating profit due to significant decrease in performance related to securities derivative products, FX caused by the rise of FX rates and the narrowing bond yield decline as well as seasonal factors, including cold waves and heavy snow led to a reduction of insurance-related income and recorded muted performance.

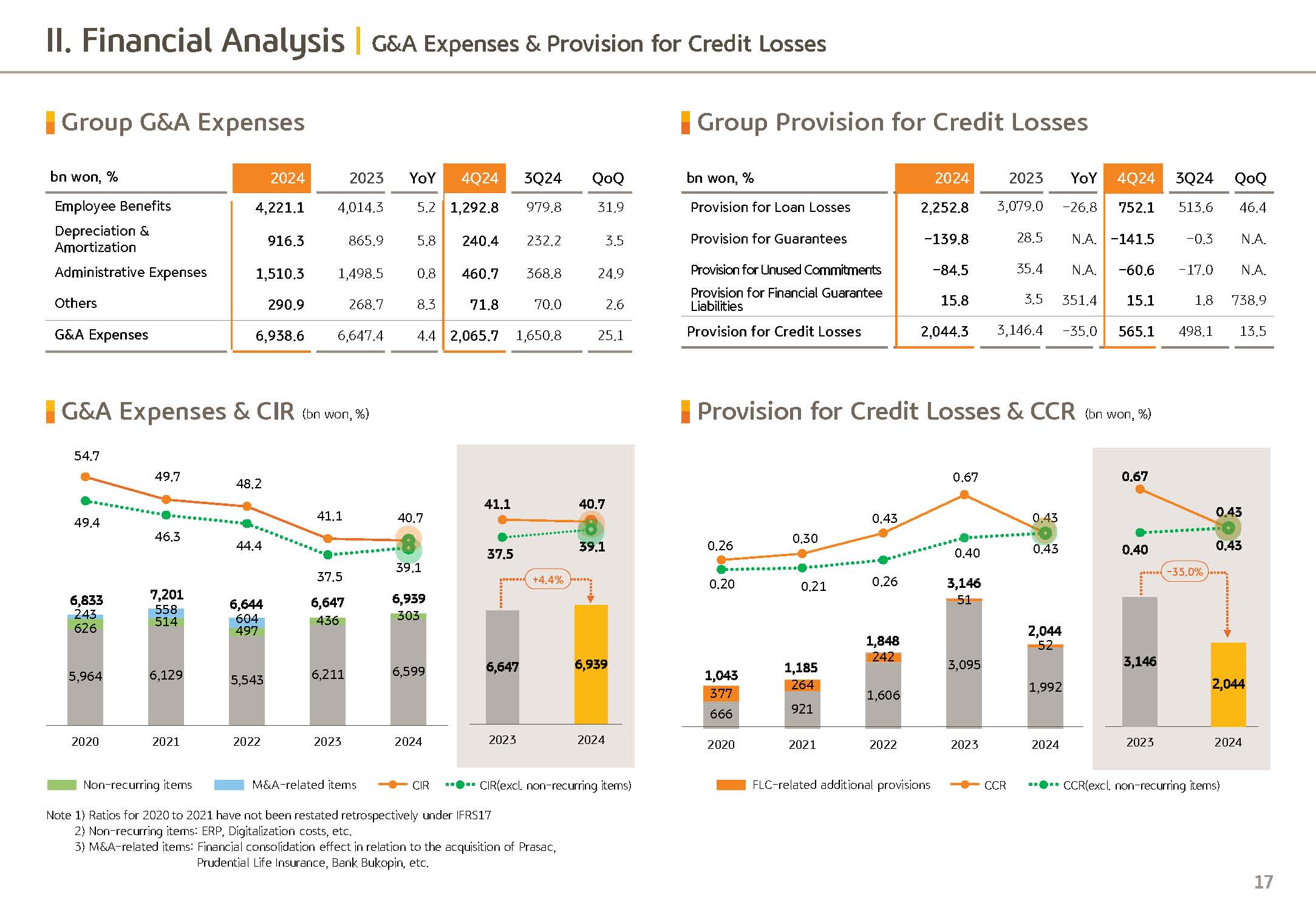

Next, I will cover G&A expenses. 2024 G&A expenses posted KRW 6,938.6 billion. And despite the increase in related costs, including ERP expansion and increasing depreciation and admin cost of subsidiaries, thanks to ERP implemented over the past several years led to the reflection of the accumulated labor cost reduction effect and is being stably managed.

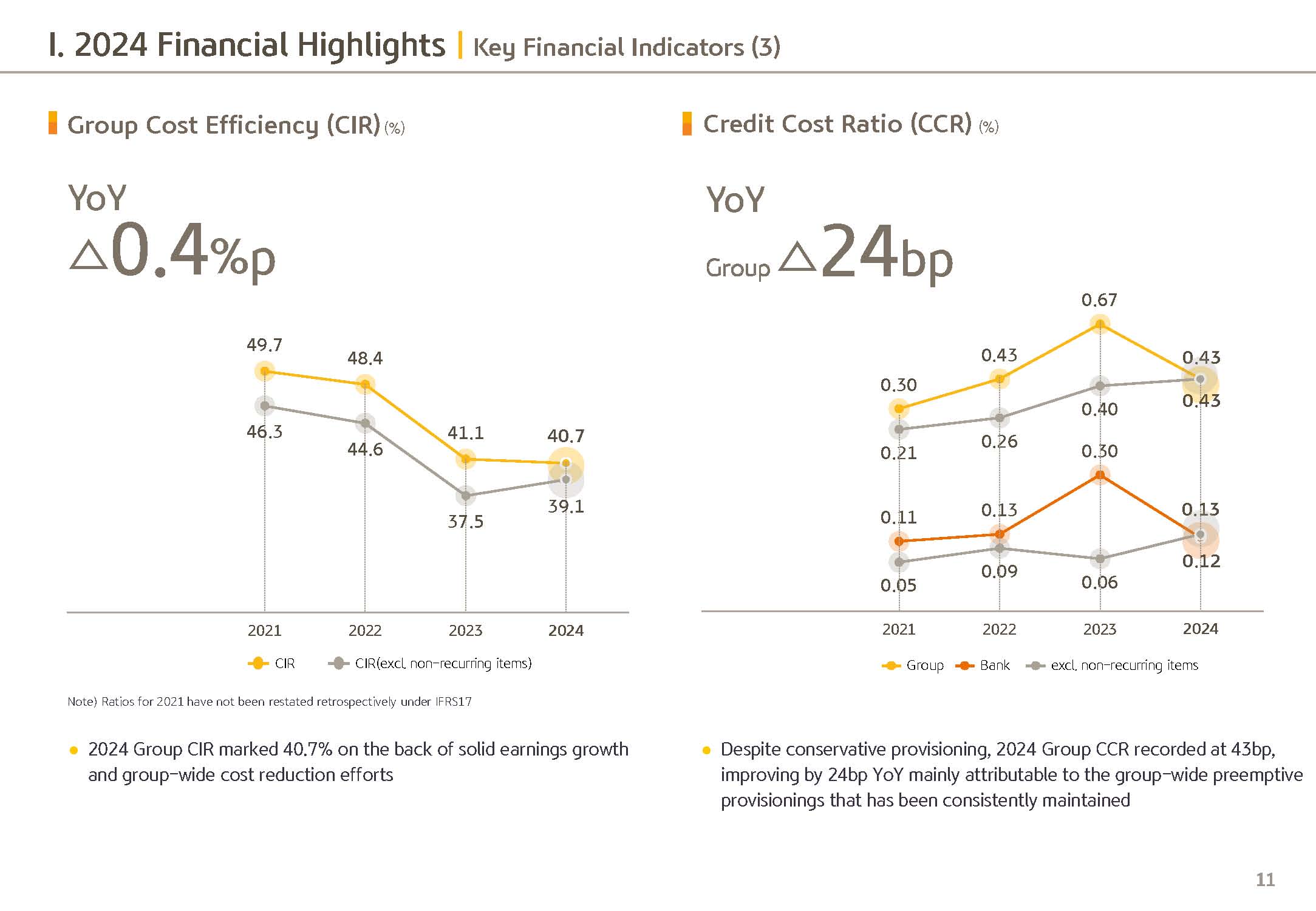

In addition, 2024 group CIR posted 40.7%. And on the back of solid top-line growth based on core profit and efforts to improve HR structure and manage costs, it declined 0.4 percentage points YoY and is showing market improvement trend in our group's cost efficiency.

Going forward, KBFG plans to strengthen cost efficiency improvement efforts. And in particular, in the case of capital budget, we plan to refrain from big bang method large amount injections and through diversified investments in line with market trends, we will minimize this effect. Also in the case of recurring costs, we will minimize fixed cost expenditures in order to improve the rigid cost structure.

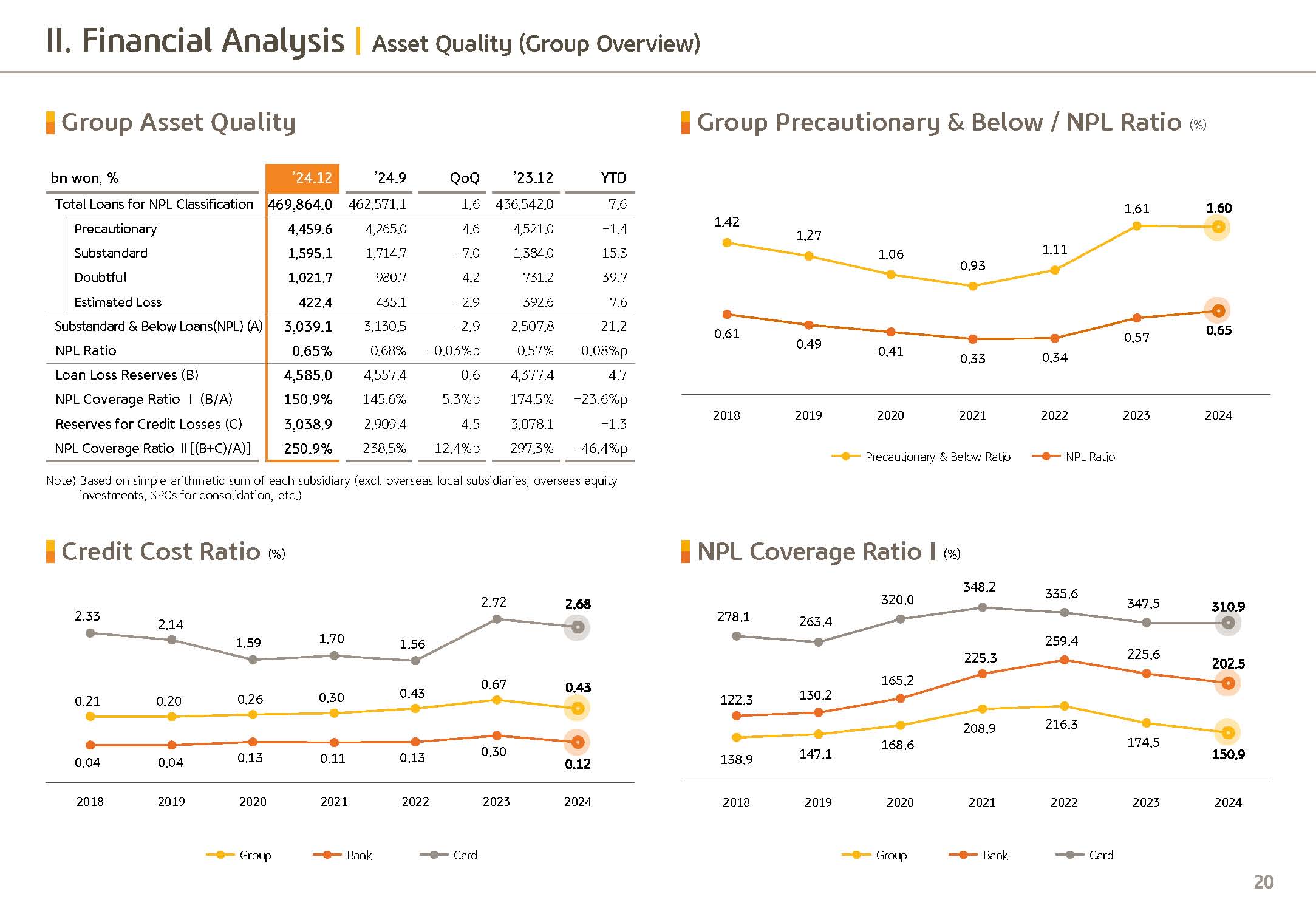

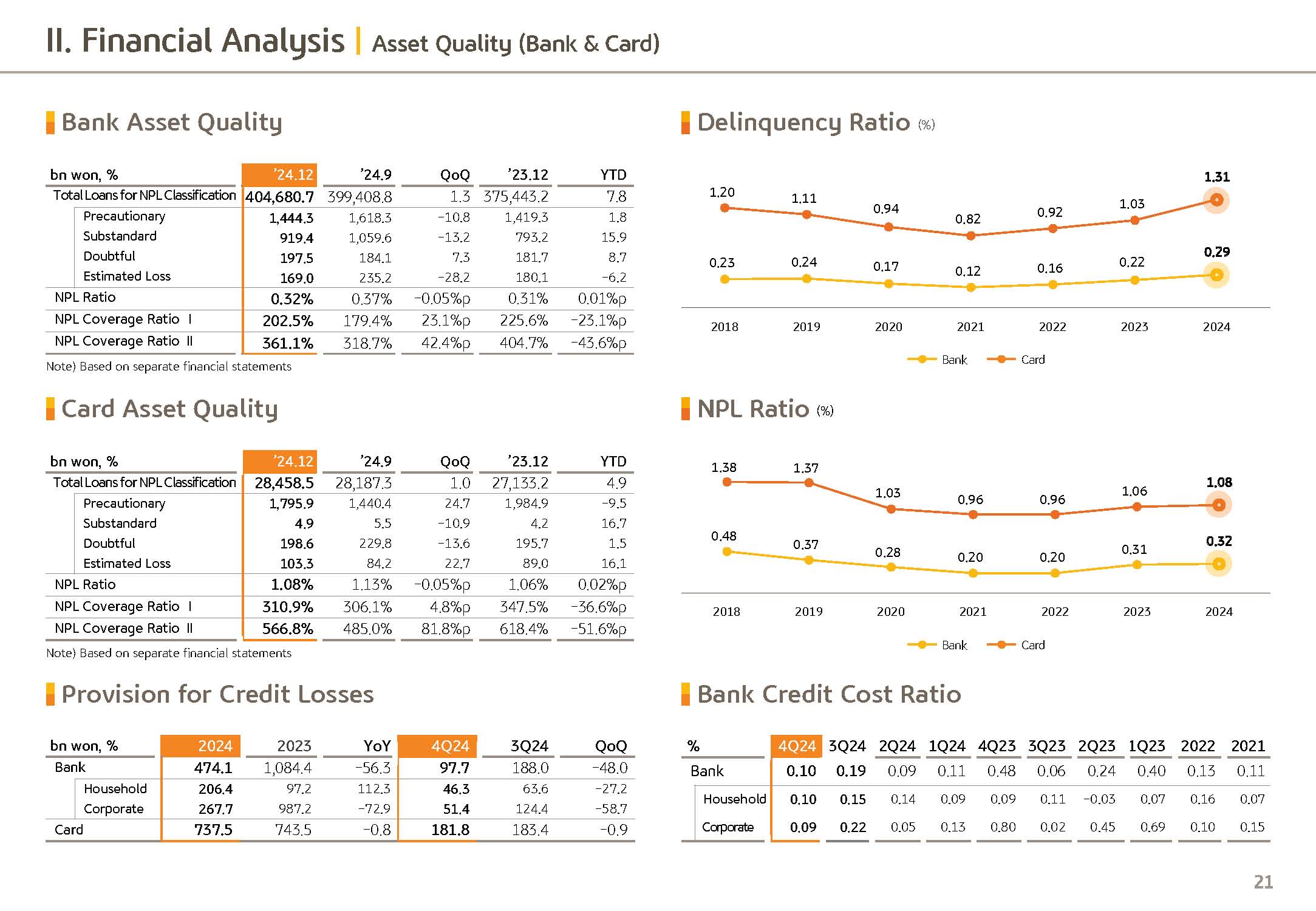

Lastly is group provisioning for credit losses. 2024 group provisioning for credit losses posted KRW 2,044.3 billion and decreased greatly YoY by KRW 1,102.1 billion. This was attributable to the effect from preemptive additional provisioning late last year, preparing for potential real estate PF and other risks as well as the effect from reversal of about KRW 263 billion yearly provisioning stemming from the bank's valuation re-rating.

In addition, 2024 group credit cost posted 43 bps and improved 24 bps YoY and some reversals took place at selectively normalized PF sites and is being stably managed within the expected range.

On the other hand, Q4 provisioning for credit losses posted KRW 565.1 billion and increased 13.5% QoQ.

and this was caused by the conservative provisioning stance of all subsidiaries preparing for potential economic condition worsening despite the bank's sizable provisioning reversals.

Going into detail, according to the asset quality rating adjustment of the bank, around KRW 68 billion was provisioned against overseas CRE exposure. And in the case of securities, around KRW 58 billion was provisioned against real estate PF and overseas acquisition financing and leasing subsidiaries, including card and capital, have provisioned an appropriate amount, reflecting the recent asset quality ratio trend under a conservative management approach.

From page 9, I will cover major financial indicators.

First, group's profitability indicators. As aforementioned, KB Financial Group's 2024 ROE posted 9.72% and improved 0.59 percentage points YoY. ROE on a recurring basis, excluding one-offs, stands at 10.76% level.

And in particular, as you can see on the right graph, this was a result of the business diversification efforts made during the past years and was possible since we secured an optimal business portfolio, including 40% non-banking contribution.

Going forward, KBFG responding to the low growth interest rate decline regime will strengthen efforts for each business. and on the other hand, continue RoRWA focused qualitative growth efforts.

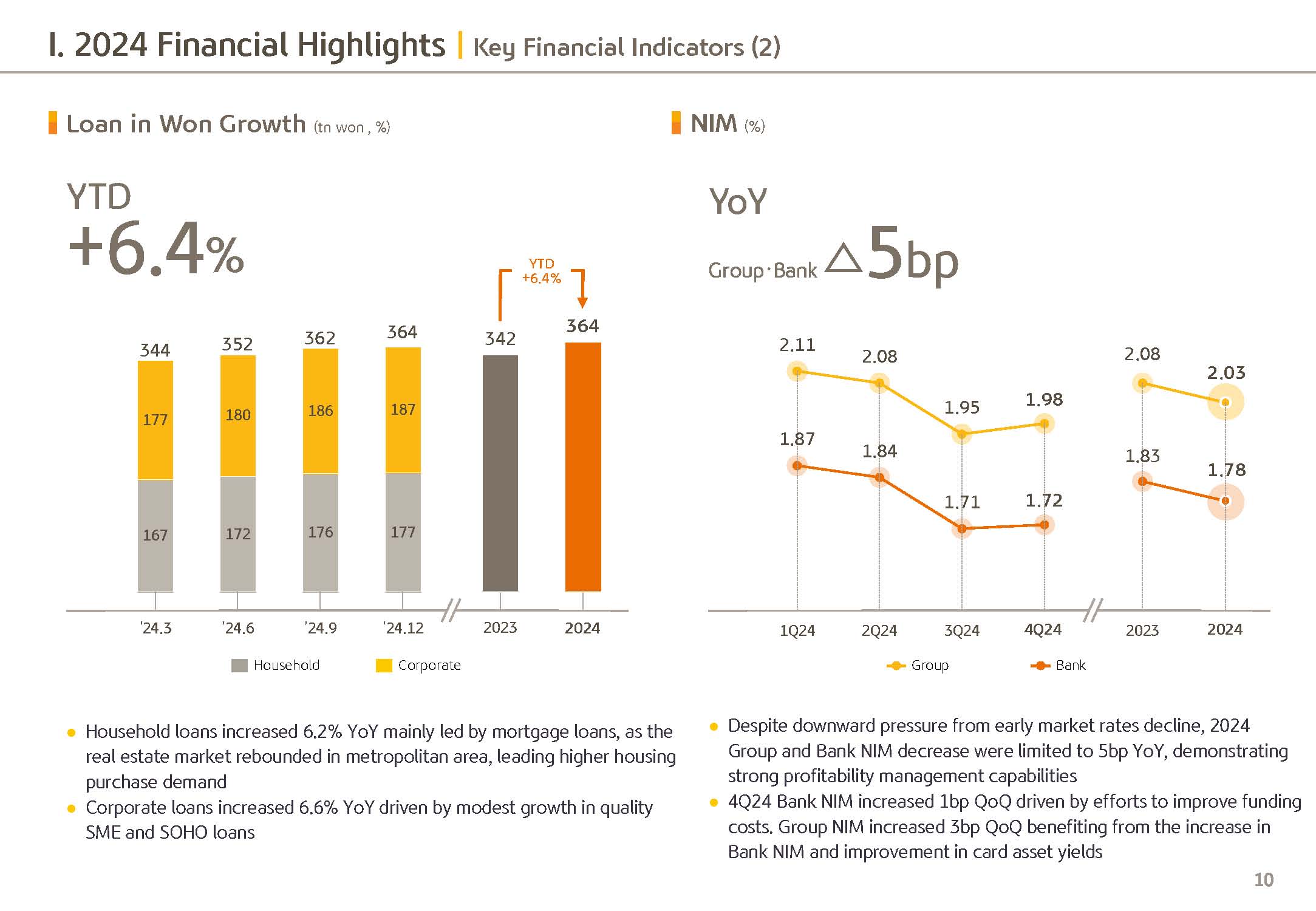

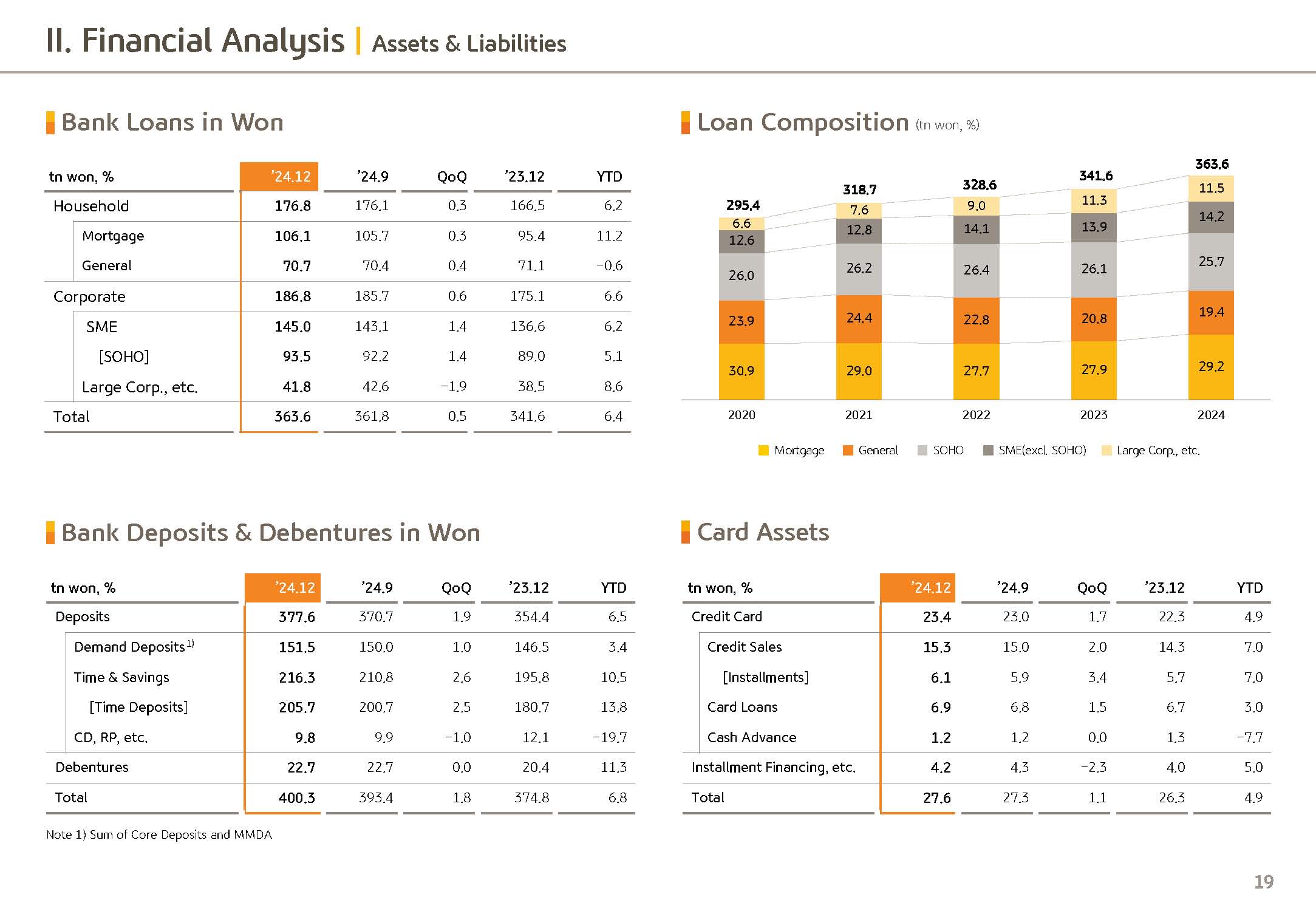

Let's go to the next page. Next, I will cover bank's loans in won growth. At 2024 end, bank loans in won posted KRW 364 trillion and increased 6.4% YTD and 0.5% compared to late September. In case of household loans, following key interest rate cuts and real estate market transaction volume increase -- saw increase in home mortgage loans and credit loans centering on actual homebuyers and rose significantly by 6.2% YTD.

Corporate loans as a result of solid growth rates centering on high-quality SME and SOHO loans led to a 6.6% increase YTD.

We plan to conservatively manage our loan policy, focusing on asset quality and profitability, taking the factors, including economic cycle, real estate market and household debt trends and other factors this year as well.

And on the other hand, minimize quarterly fluctuations considering RoRWA and plan to manage so that loan growth will be predictable.

Next is net interest margin. Group and bank's 2024 yearly NIM posted 2.03% and 1.78%, respectively, and went down slightly YoY. Despite the fact that the effect from two rounds of key rate cuts that were made in Q4 was reflected early on in the market interest rate, bank NIM stopped at dropping 5 bps YoY and once again proved profitability management capability centered on internal soundness.

On the other hand, Q4 bank NIM posted 1.72% and increased 1 bps QoQ, which was a result of partial improvement of new and balanced loan deposit spread enabled through household loan growth, speed control, and following funding amount control as well.

We expect the downward NIM trend to continue for the time being this year as well. But in line with our asset growth speed, we will flexibly control the volume and speed of funding and strengthen ALM management to strictly manage our NIM.

Lastly, let's go to page 12.

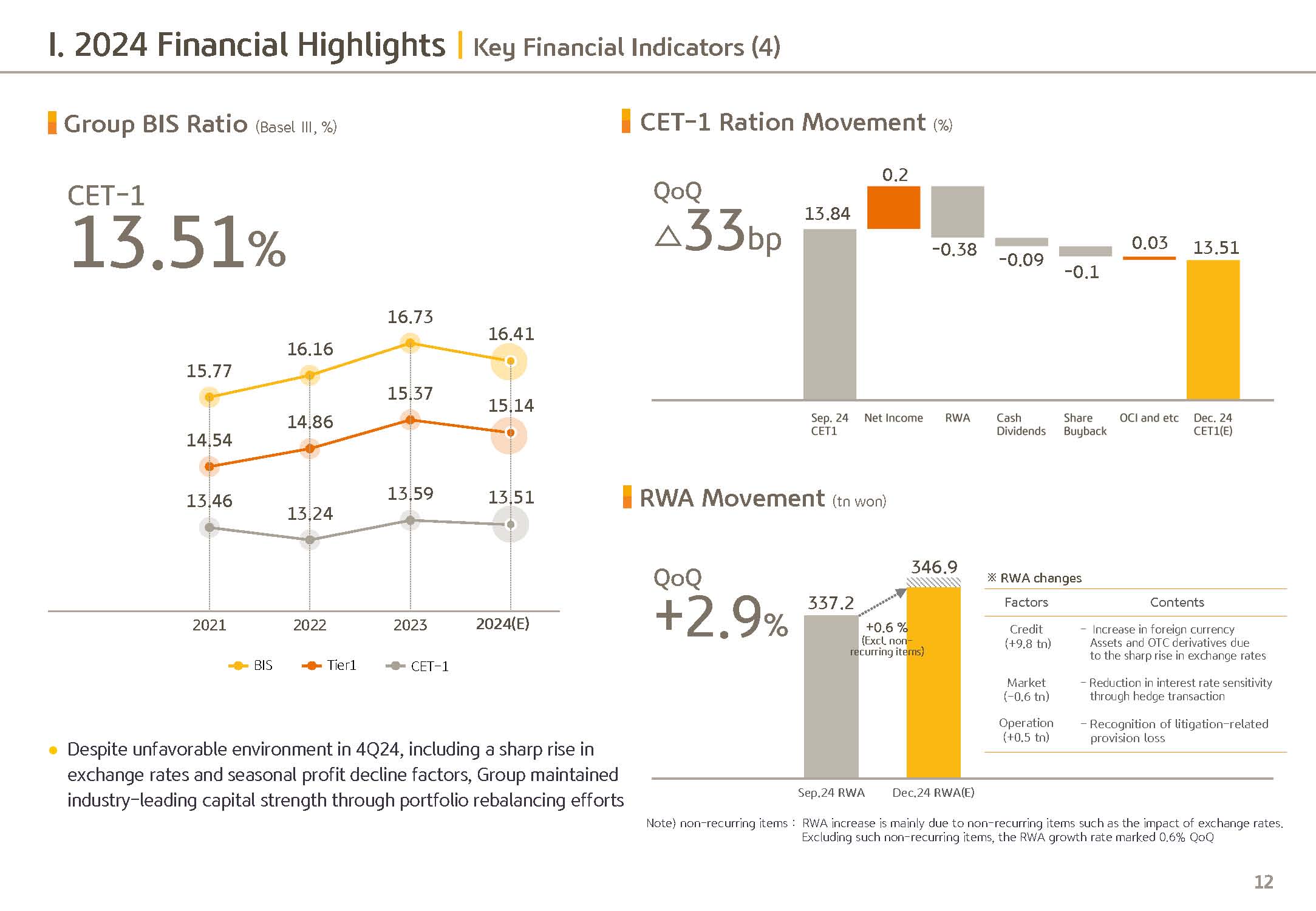

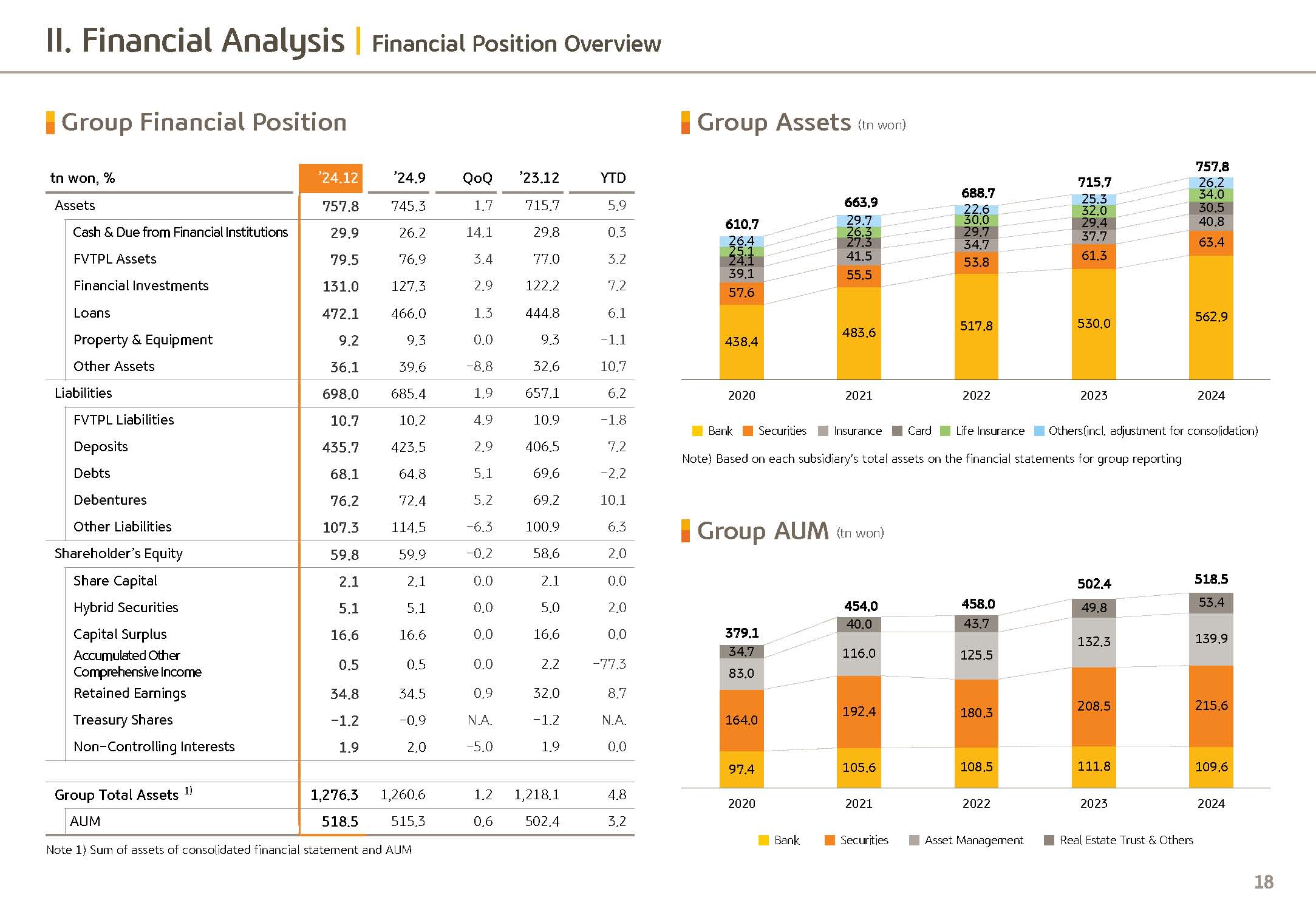

I would like to cover group's capital adequacy-related indicators. First, as you can see on the graph on the left, 2024 and group BIS ratio posted 16.41% and CET1 ratio posted 13.51%, respectively. I will explain in more detail regarding CET1 ratio on the right-hand graph.

Group CET1 ratio declined 33 bps QoQ caused by the Q4 net income amount decrease, which limited its contribution to CET1 ratio to a 20 bp level and 2.9% RORWA increase due to factors, including FX rate surge in the quarter. In addition, KRW300 billion of quarterly dividends and shareholder returns, including share buyback, which took place during the quarter led to around 19 bp level downward effect.

And as you can see on the graph on the bottom right of the page, Q4 RWA posted KRW 346.9 trillion, a 2.9% increase QoQ. There was around KRW 7.5 trillion of credit risk increase due to FX rate surge, including quarterly won-dollar FX rates rising more than KRW 150 and this contributed to a decrease of about 30 bps to the group CET1 ratio.

However, despite these downward factors, group -- thanks to rebalancing efforts, including reduction in unused credit limit is still maintaining the industry's highest level of differentiated capital capability.

In order to steadfastly implement our group's value-up framework, we will strictly manage the RWA total amount limit. And through continuous ALM monitoring, we will manage the volatility of asset growth. And to the extent that it does not impair revenue generating ability, we will strengthen efforts to improve capital efficiency through efficient asset rebalancing considering RoRWA.

Please refer to the details of our business results from the next pages.

And with this, I will conclude KBFG's 2024 business results presentation.

Thank you for listening.